Now what?

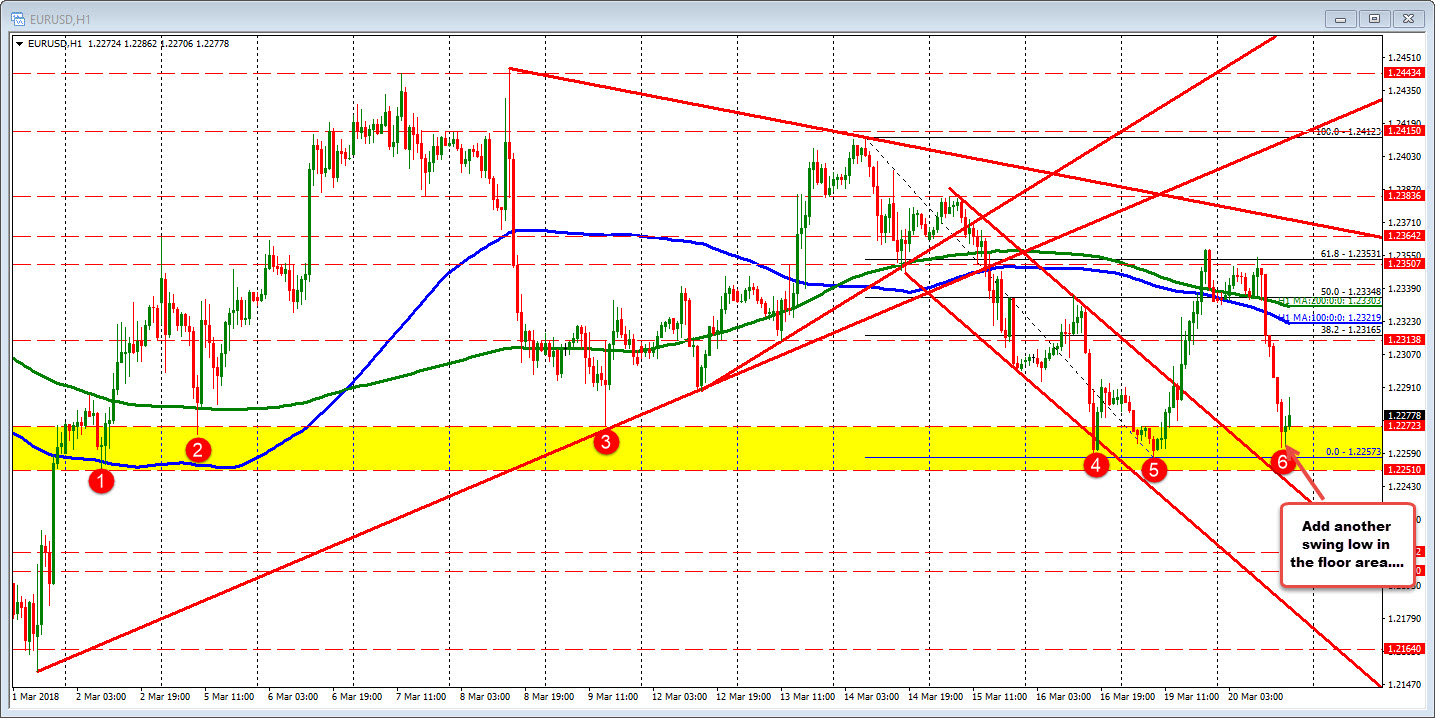

The EURUSD was on a mission lower today. The pair fell below the 200 and 100 hour MAs and sellers took the pair lower and lower and lower. Until, that selling took the pair into a floor swing area, that has defined lows since March 2nd. That area comes in at 1.2251-72 (see earlier post).

Both yesterday and Friday bottomed the area, and today, the selling stalled - at least for now - in the area too. I wrote about that earlier when I said:

"So, if the price does dip to the "yellow area", don't be surprised to see the buyers sticking a toe in the water again, with stops on a break. Be aware."

What now?

The story does not change. If the 1.2251 level is broken, that is not good for the pair. The floor is not holding. The dip buyers will likely give up on the trade.

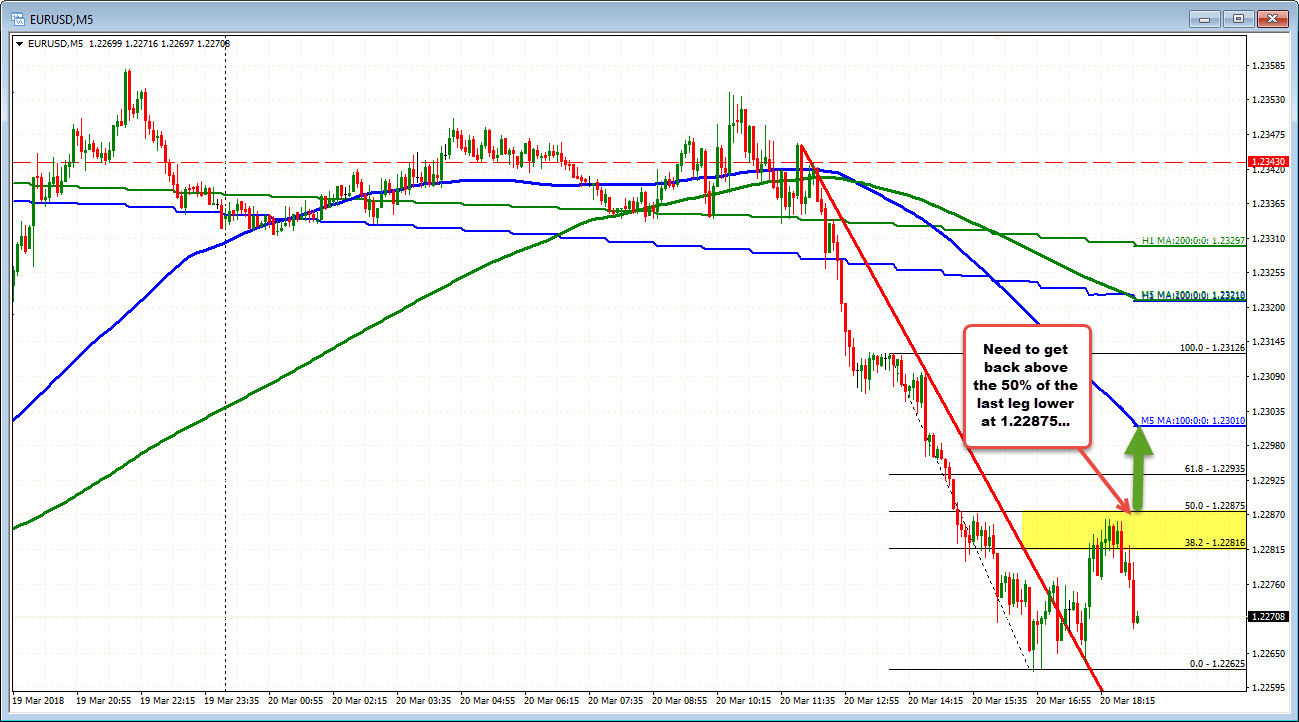

On the topside, the correction off the low did correct about 50% of the last leg lower today (see the chart below). For the buyers to feel like they did pick the bottom again, they need to get back above the 50% at 1.22875. That would be step one for the pair - and give the buyers some relief on their dip buy.