Canadian CPI, headline and core, is due at 1330 GMT on Friday 23 February 2018

To start with, here are a few more "what to expects" from Canadian banks

Any bolding is mine

RBC:

- We see a firm 0.6% m/m gain for headline CPI in January, partially supported by higher gasoline prices in the month.

- However, last year's even stronger headline increase in January should not repeat itself, with substantial declines in YoY rates for gasoline, autos/recreational vehicles and travel services prices expected, taking the headline YoY rate down to 1.6% from 1.9%. The latter two will influence the ex-food and energy measure as well (declining from 1.7% to 1.5% y/y), with a more modest - but non-zero - potential impact on the BoC's three core measures.

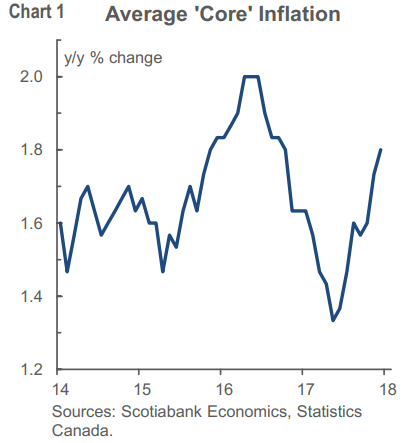

- The average of those measures rose to 1.8% in December, the highest since October 2016.

- Restaurant prices - last at 2.9% y/y - are the most likely to show an immediate impact from the Ontario minimum wage increase on January 1st

Scotiabank:

- Headline CPI inflation is likely to decelerate in year-ago terms when January's reading arrives on Friday but the experience with US CPI lends caution to the expectations.

- Base effects alone would drag headline inflation down from 1.9% y/y in December to just 1% y/y in January. To overcome this and keep the headline flat would require a hefty 0.9% lift in average seasonally unadjusted prices in January over December. That would be about triple the normal pace for January in the past five years but exactly what we got in January 2017.

- A roughly 3% m/m rise in retail gasoline prices should contribute a weighted 0.1% m/m NSA gain to CPI and thus reinforce the average seasonality effect in the CPI basket while nevertheless knocking about 0.1 off the year-ago CPI inflation rate compared to the prior month.

- ... A reason for being more cautious like this would be if there is an abnormal weather influence upon prices in Canada like there may have been in the US.

- As usual, the key will remain whether the average of the three core measures continues to drift higher. This is the single most important point of data dependency to the BoC. However, neither the BoC nor consensus forecast the measure that, by definition, requires the full spectrum of data laid bare before knowing what to weed out of the tails in the common, weighted median and trimmed mean measures.

TD Securities:

- Energy prices should help drive a 0.6% gain due in part to adjustments in carbon pricing.

- Base effects will see inflation slip by 0.3pp to 1.6%, but this should prove temporary before a rebound in Feb.

- Outside of energy, momentum in core goods should stabilize as higher mortgage interest costs offset decelerating new home prices; food prices to be a source of strength.

---

And, here are those posted previously:

- Going into today's Canada inflation report - support & resistance for USD/CAD

- Preview of Canada CPI data due Friday

- More previews of Canada CPI data due Friday

ps. Who is this guy?