Gold up. Dollar lower. Oil up and US stocks a little down

As the Europeans look to head home for the day, the stocks have closed for the day. The results are mostly unchanged to lower, with the German Dax the big loser:

- German Dax down -1.2%

- France's CAC down 0.2%

- UK's FTSE unchanged

- Spain's IBEX unchanged

- Italy's FTSE MIB unchanged

- Portugal's PSI 20 up 0.35%

In the 10 year note sector today, yields were little changed in Europe:

- Germany 0.351%, unchanged

- France 0.668%, unchanged

- UK 1.276%, unchanged

- Spain 1.457%, -2.1 basis points

- Italy 1.767%, -1 basis point

- Portugal 1.91%, down -0.7 basis points

- Greece 5.369%, +3.4 basis points

In other markets as London/European traders look to exit, a snapshot shows:

- Spot gold up to $10.10 or 0.8% at $1290.72. The price of gold is being supported by a lower US dollar

- WTI crude oil futures are trading up $1 or 1.74% at $57.86. The Keystone pipeline cut deliveries by 85% or more through the end of November. Last week there was a 5000 barrel spill in South Dakota. Reports that OPEC was inviting other non-OPEC nations to participate in their production cuts is also being cited as a reason the rise

- US yields a lower. That too is contributing to our gold and a lower USD. Two-year 1.743%, -2.8 basis points. 10 year 2.3365%, -1.9 basis points. Thirty-year 2.753%, -0.4 basis points

- US stocks are little bit lower. S&P index is down -2.5 points or -0.1%. NASA composite index is down 1.7 points or -0.2%. Dow industrial average is down 52 points or -0.22%

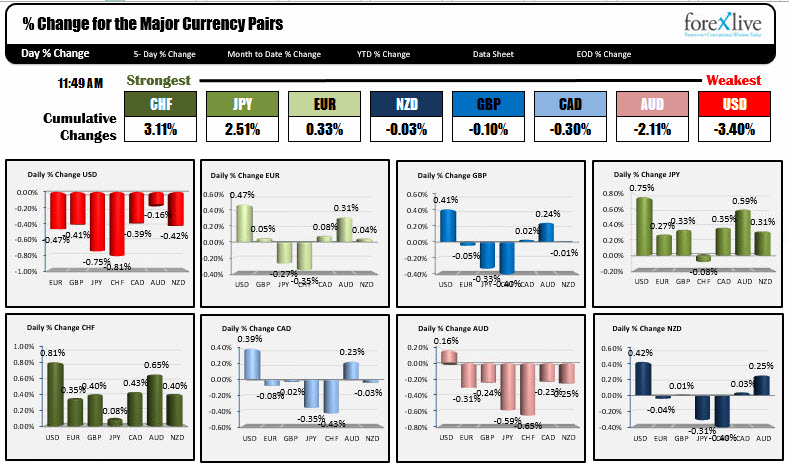

IN the forex market, the USD has been a big mover in the the NA morning session. It has accelerated lower vs all the major currency pairs. The beneficiaries have been the USDJPY - which fell below its 38.2% retracement, 200 day MA and 100 day MA, and the USDCHF which also tumbled lower - breaking to new month lows and approaches the 200 day MA and 38.2% retracement levels. Below is a current snapshot of the % changes of the major currencies vs each other.