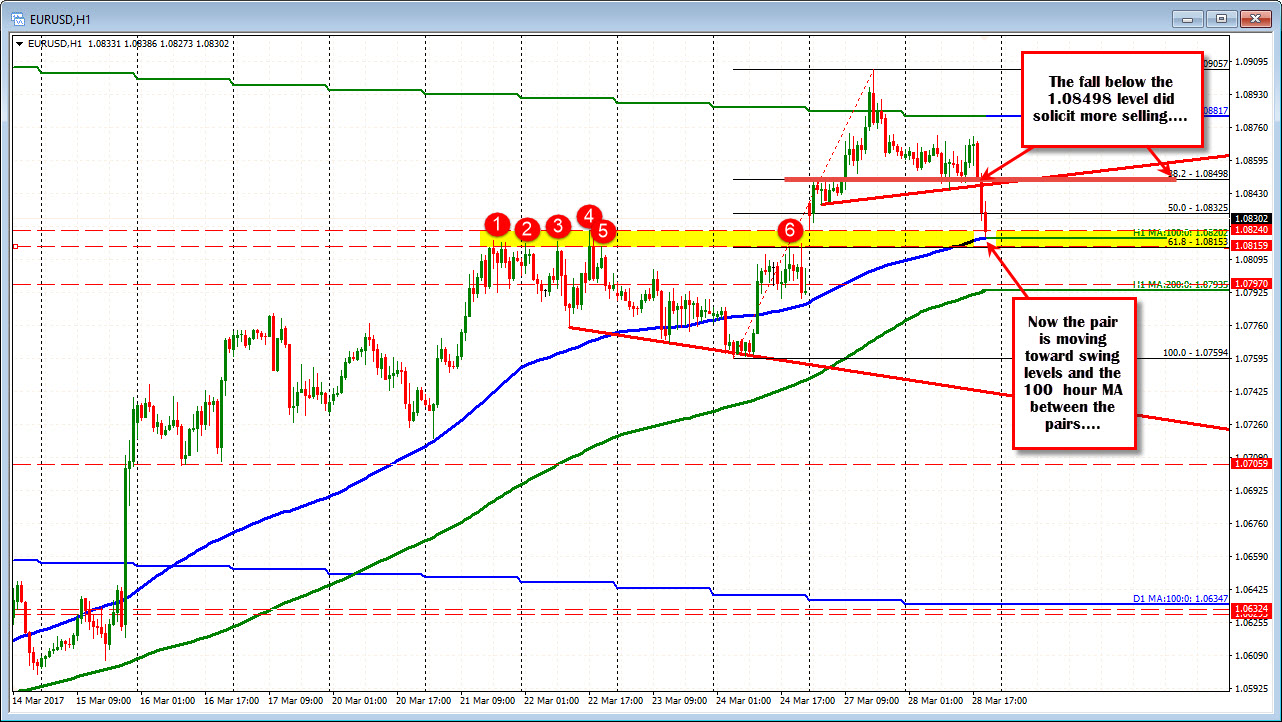

Range extended below the 38.2%....

The EURUSD fell below the 38.2% retracement level at the 1.08498 level (see prior post) and the 27 pip trading range has been extended. With the help of supportive comments from some Fed officials (reminds us about the pace of hikes) the price has continued down to support area defined by swing levels AND the 100 hour MA at 1.0820. We are finding the customary buyers on the first look at the 100 hour MA level. The pair has also ALMOST filled the gap from the 1.0817 to 1.0824 level. Anyway, risk could be defined and limited against this support area (stops on a move below).

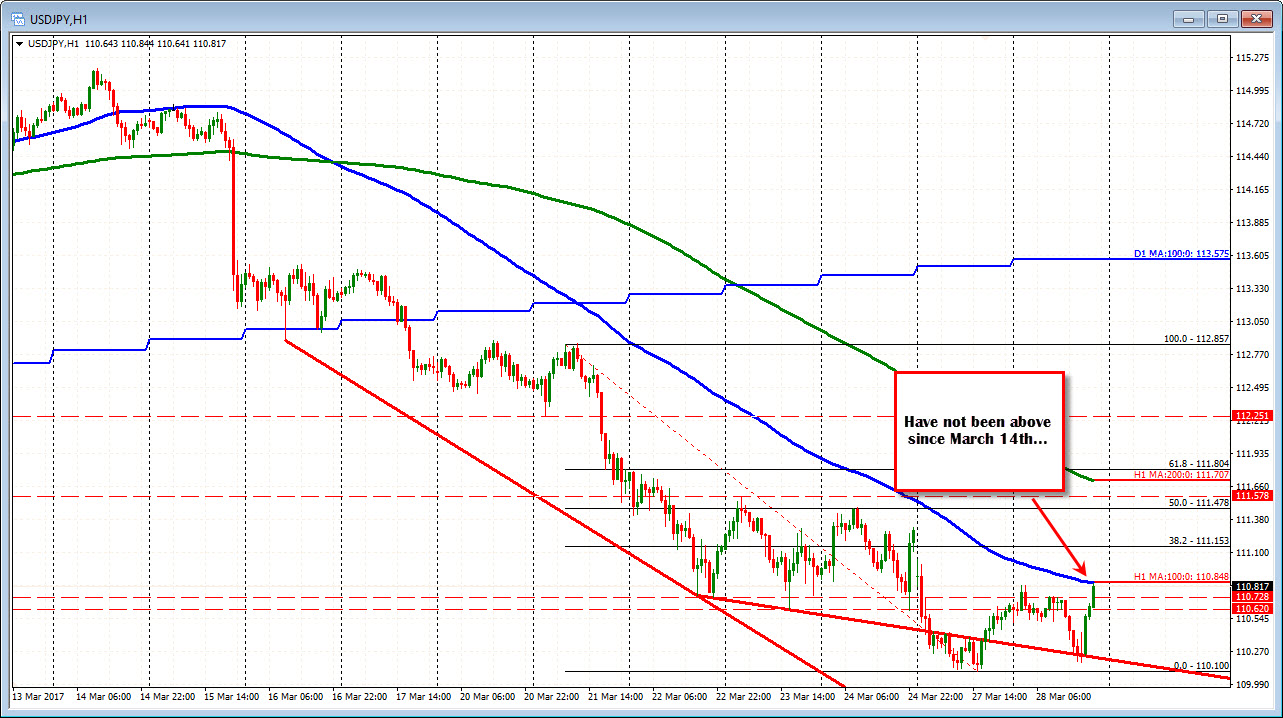

Looking at the USDJPY, that pair extended its trading range by a few pips and in the process has run into it's 100 hour MA level as well. That MA comes in at 110.848. A break above is more bullish. The price has not traded above the 100 hour MA since March 14th. The 38.2% of the move down from last week's highs comes in at 111.15. The 50% is at 111.478 and corresponds with the high from Friday. The 100 hour MA is up at 111.708.

PS Helping the dollar is the 10 year yield is trading at 2.401% now. That takes its yield just above its 100 hour MA at 2.39% (see prior post).

Dollar buying technicals in the EURUSD and USDJPY are getting in line but 100 bar MAs are in play and may stall. If there are breaks, and we go further.