Remarks on the euro via Westpac, noting:

pricing for a 15 March rate hike surged in response to Fed chair Yellen's testimony and strong data

EUR/USD risk is particularly elevated for 15 March as it is also election day in the Netherlands

The note goes on:

Event risk:

- The prelim Feb PMIs and final Jan CPI lead the EZ data calendar next week. There are no ECB speakers scheduled

Bias:

- EUR firmed through Jan, from sub-1.04 to highs near 1.0830, backed by less negative yield spreads as stronger data in the Eurozone and elsewhere put the US in a less exceptional light and as Trump reflation expectations took a hit. Since then core EZ-US 2yr spreads have retraced almost all of that Jan move and appear poised to break out to new EUR negative lows. Yet EUR/USD has only retraced about 50% of the Jan rally

- Fed March hike odds around 45% are approaching a near term ceiling but should remain at least at current levels and could drift a touch higher going into Trump's address to a joint sitting of Congress

- Meanwhile on the EUR side, safe haven flows are likely to suppress core bund yields at least until upcoming elections in the Netherlands (15 March) and then France (2nd round run-off 7 May) are out of the way. Sell EUR/USD into strength above 1.06 for a continuation of the down move.

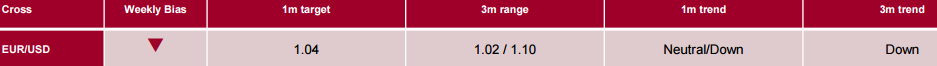

Targets: