What to expect from the dot plot

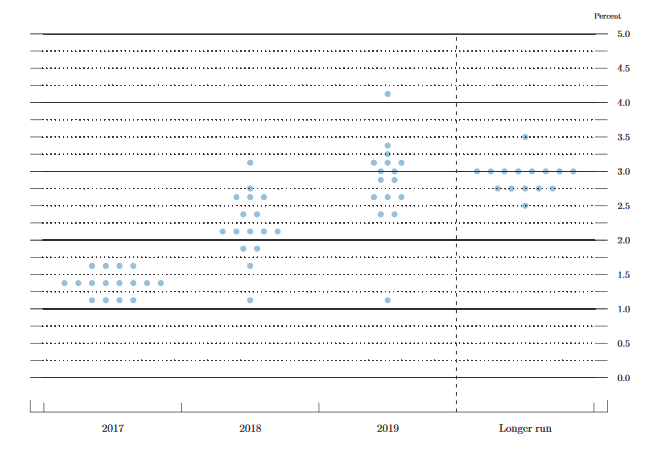

FOMC members last made interest rate projections ahead of the June 14, 2017 FOMC meeting. Here was how it looked.

The current Fed funds rate is in the range from 1.00%-1.25%.

As you can see from the dots, 12 of the 16 FOMC participants saw rates at 1.25%-1.50% or higher, with only 4 anticipating they would remain unchanged through year end.

That's combined with a consensus GDP estimate at 2.2%, which is still realistic despite the double dose of hurricanes.

What changed? Core inflation probably won't hit the 1.7% projection but it won't be far off. Yet there is less confidence it will hit 2.0% in 2018 and 2019.

That all-but-insures the projections for those years will be ratcheted down at least a few notches.

But what will matter most to markets is the signal about this year. If find it tough to believe there still won't be a strong signal about a hike.

For sure, the four dots that expect rates unchanged will stay. Those are likely from: Kashkari, Bullard, Brainard and Evans but we don't know that for sure.

They could be joined by Kaplan but it's tough to see a big swing beyond that, and they will need at least three more votes to shift. And if the FOMC collectively sends a dovish signal, that would preclude a December hike. I don't think that's an option they want to take away.

My guess is that the FOMC is going to send a hawkish signal with the dot plots and that the US dollar will gain in the aftermath.