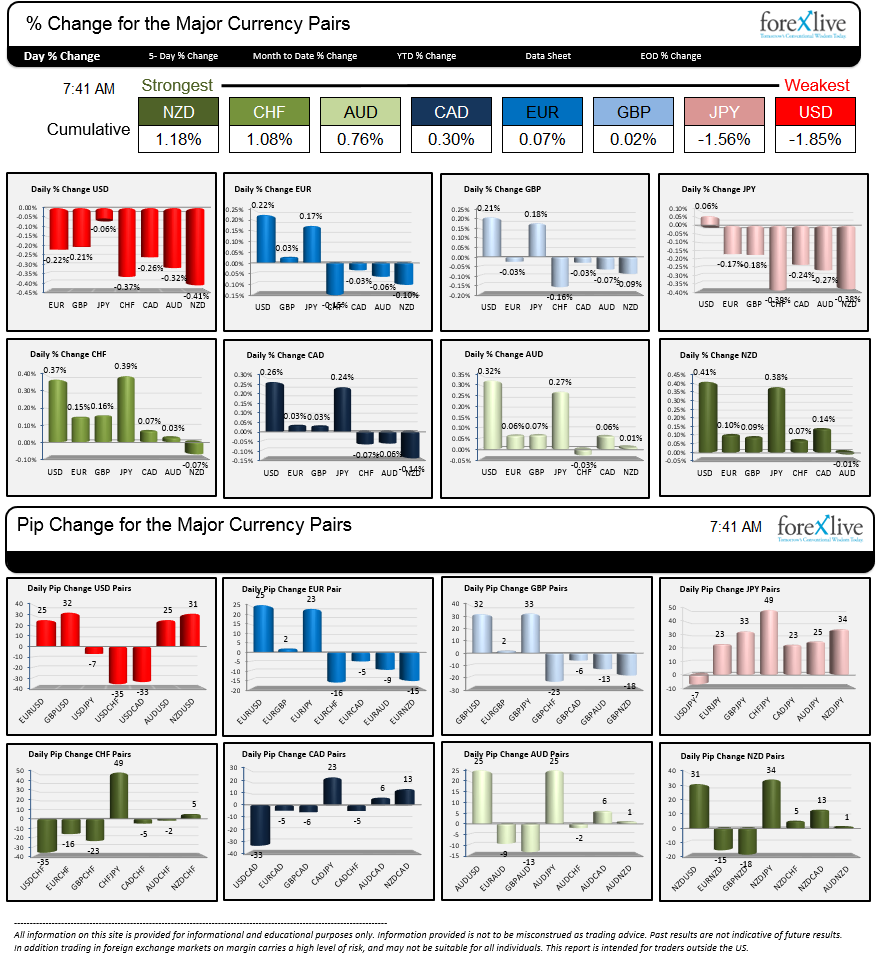

NZD is the winner. USD is the loser.

Taking the percentage change from the 5 pm close yesterday of each major currency vs. each other, and adding up the sums of those changes, yields an unweighted rank of the strongest and weakest currency. Doing that today, shows that the New Zealand dollar is the strongest, rising against all the major currencies (as of 7:41 AM ET). The weakest today, would be the US dollar, which has fallen vs. all the major currencies in trading today.

Overall, the snapshot - as US traders enter for the day - is relatively little changed vs. yesterday's close. The largest distance in pips between the close from yesterday and today is only 49 pips (CHFJPY is higher by that amount). There are a number of pairs which are showing changes of less than 15 pips. The market is taking a break after yesterday's move which had all the interest focused on the US dollar rising.

Why the funk?

Today is Friday. Today is the last day of the trading month. Two good reasons to expect choppy conditions in all markets.

However, today the calendar is full of economic data:

- German CPI will be released at 8:00 AM The month on month is expected to rise by 0.6%. Looking at the releases from the regions shows that that number will be higher.

- GDP 4Q (second cut) will be released at 8:30 AM. (est 2.0%, Personal consumption 4.3%, Price index 0.0%, Core PCE QoQ 1.1%)

- Chicago PM will be released at 9:45 AM. The estimate is 58.0 vs. 59.4

- US pending home sales for January will be released at 10 AM. The estimate is 2.0% vs. -3.7%.

- University of Michigan sentiment index will also be released at 10 AM. The estimate is 94.0 vs. 93.6. This is the final cut for February.

- Fed's Stanley Fisher ECB's Constancio and Bank of Japan's Nakaso are on a panel discussion in Chicago. That is to take place later today at 1:30 PM ET.

The ranges are narrow. The dollar is coming off a big day up yesterday. Will the GDP start something? If it does, I do not think the impact will be too great.