Double bottom on Friday helped buyer today

The AUDUSD is up testing the falling 100 hour MA at 0.7543 (blue line in the chart below). The level should attract seller on the first look, with close stops on a break.

The pair on Friday made a double bottom just ahead of the natural support at 0.7500 (lows reached 0.7502 - see ). The move higher took the price up to swing highs in the 0.7532 area. The current push higher took the price above that area. It will be eyed as close support now.

The sellers are leaning on the first look. Can we go above?

Sure... but it is going against the bearish trend seen over the last few months.

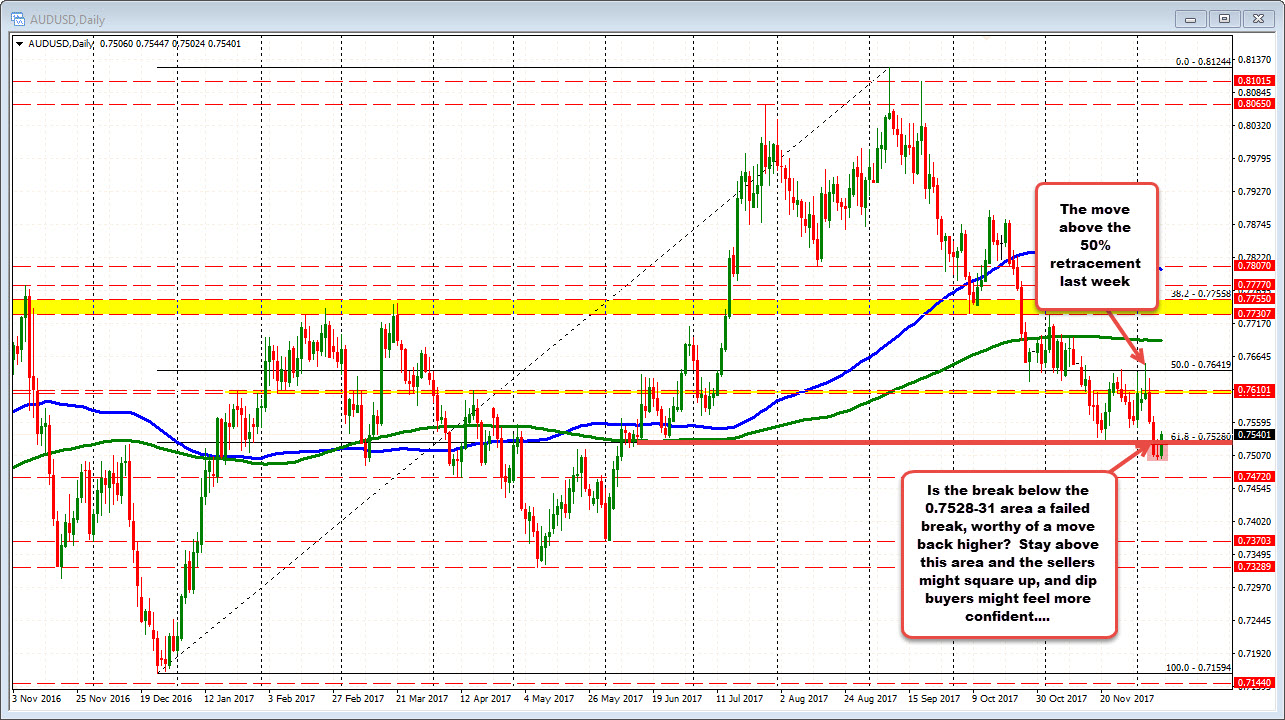

Looking at the daily chart below, the price has been stepping lower. Last week, the price high tried to move back above the 50% retracement at 0.76419, on Tuesday, but failed on that run. The price closed near the low on that day and marched lower for the rest of the week.

The price did fall below the 61.8% and swing levels near the 0.7528-31 area. We are back above that level (bullish above the level). That is the bullish light in an otherwise bearish view...

So going forward today, on a dip back down off the 100 hour MA, watch for close support at the 0.7528-31 area (If long that might be close risk level now).

Stay above, and it shows the buyers/bulls are trying to push higher technically. Look for a break of the 100 hour MA and more momentum higher (with 0.7550-56 as a cluster of swing lows going back to end of November/early December to get back above - see hourly chart)).

Move below and the technical talk will shift toward "how the 100 hour MA stalled the rally". That would give seller more confidence again.