Lower on the month. Consolidated near the lows.

The month of February was a "take a breather" month for the EURUSD. That is not much of a surprise given the trend month in January, which saw the pair have an oversized 1003 pips trading range. In February the range was a more modest 357 pips.

For most of the month, the pair was preoccupied with the headline news from Greece. That "can was kicked down the road" with a four month extension of the loan agreement. Although, there will likely need to be another bailout down the road, the EU (and the market) will deal with that later. For now there was no Greek exit (or Grexit) and although that bullet was dodged the EURUSD remained in a consolidative range for much of the month.

The uncertainty from the event (and countless headlines) gave traders the incentive to like the market not love it. Although the net shorts remained throughout the month (at least from the weekly commitment of traders reports), the action was more two way with a move higher followed by a move lower. Apart from a strong US employment report at the beginning of the month, the US data was more mixed/disappointing in the month. This too helped contribute to some of the up and down choppy action.

With Greece, settled, traders made a play to the downside on the next to last trading day of the month. The extension to the downside on February 26th, turned the technical bias to the downside going into the new trading month.

Some technical highlights:

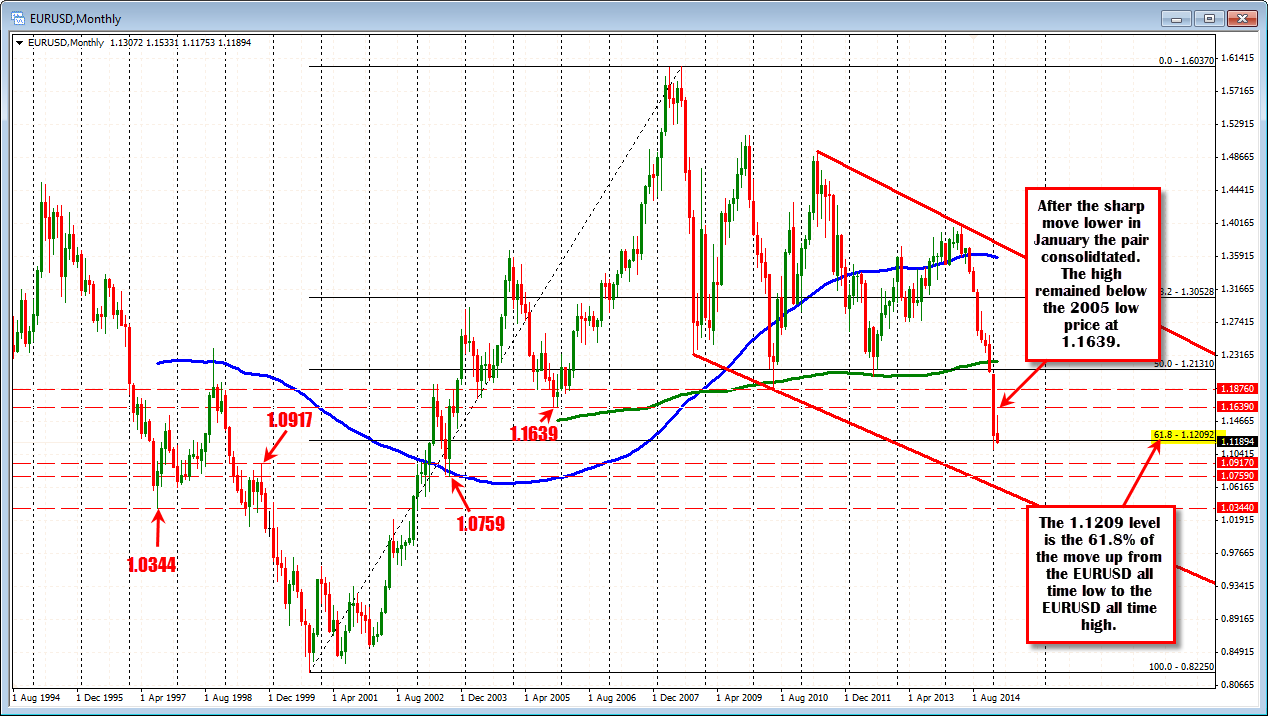

- The high for the month extended up to 1.1533. The high was able to stay below the November 2005 low at the 1.1639 level. This remains a key level on the topside that if the price can stay below, the bears are more comfortable and in control

- The low could not extend below the January 2015 low (at 1.1097). As a result, there were "no new lows going back to 2003" in the month.The 1.1097 level is a target level to get and stay below in March for the trend down to resume.

- The price closed below the 1.12092 level. This is the 61.8% retracement of the move up from the 2000 year low to the 2008 year high. This will be a close resistance level for traders into the new trading month.

- The price closed the month below the prior month close at 1.12785 area (more bearish).

Looking at the hourly chart (see below):

- The price moved below the month swing lows on the next to last trading day of the month. Those lows came in between 1.12605 and 1.12790. Into March, that is the risk for shorts. Stay below that ceiling area, and the bears remain in control. Putting it another way, "The price should not trade back above the 1.12605-79 area.". If it does, there should be further upside momentum in March.

- The low in trading on Friday found support against a low trend line. A break below that line is the next downside target for the pair. That level comes in at 1.1173 area (and moving lower as each hour passes).

Overall, the EURUSD stayed steady for most of February, but ended the month with a more bearish bias. If that bearish trend continues into March, the pair would next look toward the 1.0917 high from October 1999, or - on a stretch and trend month - the September 2003 low at 1.0759.

Conversely, if the market does not find the follow through selling, and there is a move back above the 1.1209 then 1.1260-79 area, the pair would be back in the bellow the the February trading range and I would not be surprised to see the 1.1500 area again.