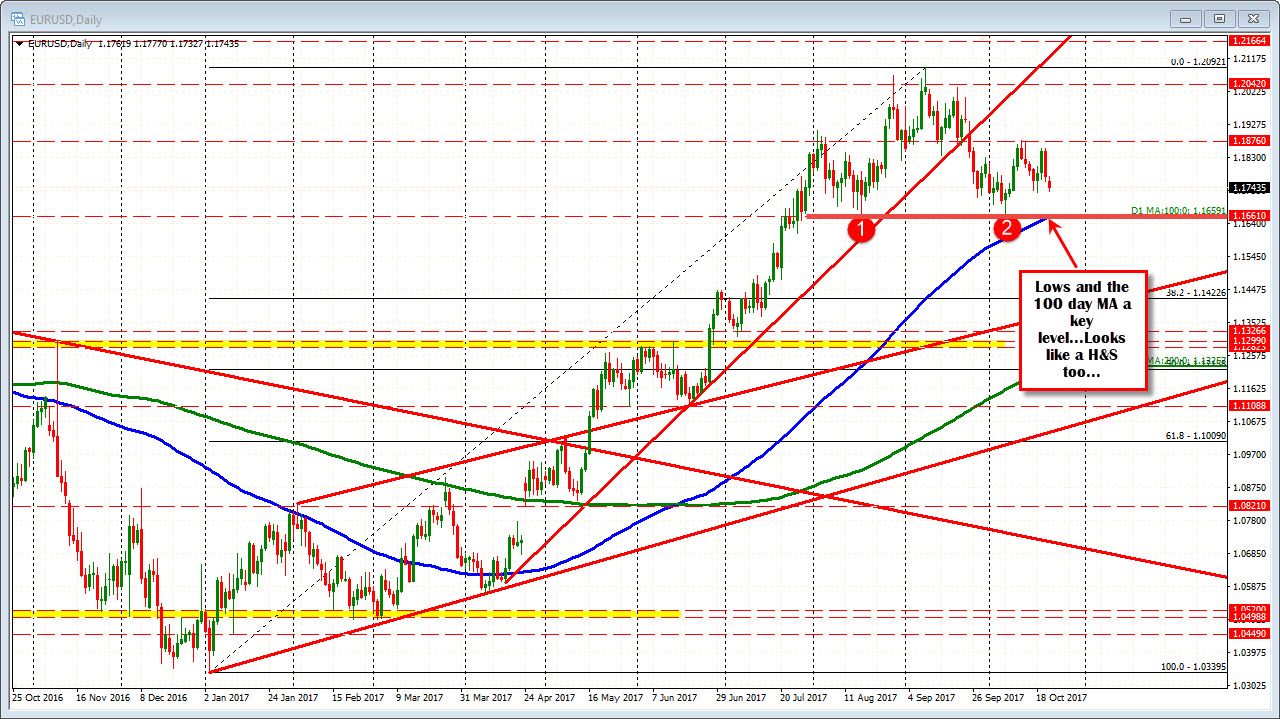

Held below MA resistance at the peak

The EURUSD is trading near the day's session low in early NY trading. The pair is close to the low from last week's trading at 1.1729. The 1.1716-20 is another target area to get to and through, along with the 1.1711. The 1.1711 was the swing high going all the way back to August 2015. So there is a lot of levels ahead that could make the bearish sledding a bit tough. Be aware.

The pair kept a bearish bias earlier in the day when the pair's corrective peak in the late Asian/early European session stalled against the 100 bar MA on the 4-hour chart (blue line in the 4-hour chart above). That MA came in around 1.1780. The high for the day peaked at 1.1777. That level was outlined in the look ahead post from last Friday (see post here). Staying below was certainly bearish and has set the technical tone for the day.

One thing to keep in mind for the EURUSD is the range for the month is only 211 pips this month. There have only been 2 months with a more narrow range going back to start of the EURUSD. The low for the month is 1.1668. The high is 1.1879.

We are nearer the low for the month. Keep in mind that at the highs, the level was a pretty good one to stay below. At the high for the month, the pair stalled at the

- 200 bar MA on the 4-hour chart (green line in the chart above),

- The 50% of the move down from the September high and

- the 1.1876 level - which was the swing low from June 2010.

So that high was a a pretty good level to stall against and sellers were aggressive. As a result, the low extreme seems the easier hurdle to get below if the range is to be extended. That increases the 100 bar MA on the 4-hour chart as a key barometer for bullish/bearish bias this week. Staying below will make extending the range for the month to the downside easier. Move above, and there may be something in the air/news that suggests a higher EUR/lower USD. The price action, and tools applied to the price action will tell us the story. Listen.

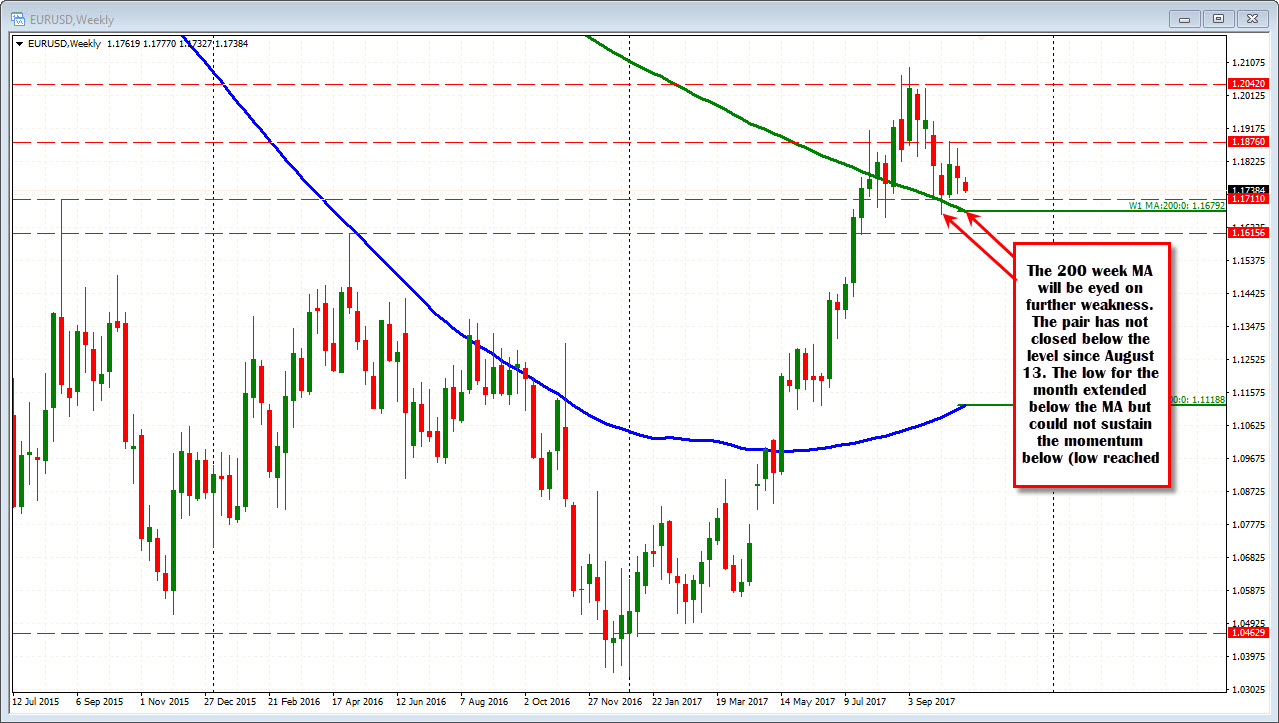

PS The 1.16792 is the 200 week MA this week. The price has not closed below the MA since August 13 week. The low for October was once again just below that level at 1.1668. Key area this week.

PSS. The ECB meets on Thursday

PSSS. The 100 week moving average is at 1.1659. That is also near the low from AUgust at 1.1661 and this month at 1.1668.

PSSSS. Closer risk for shorts today would be the 100 bar MA on 5-minute chart at 1.17488, and/or the 38.2-50% of the move down today at 1.1749-549. The 200 bar MA is moving toward that area and will also be a barometer for intraday bias. Stay below that stuff and the sellers are more in control....