The trend down continues but momentum fading

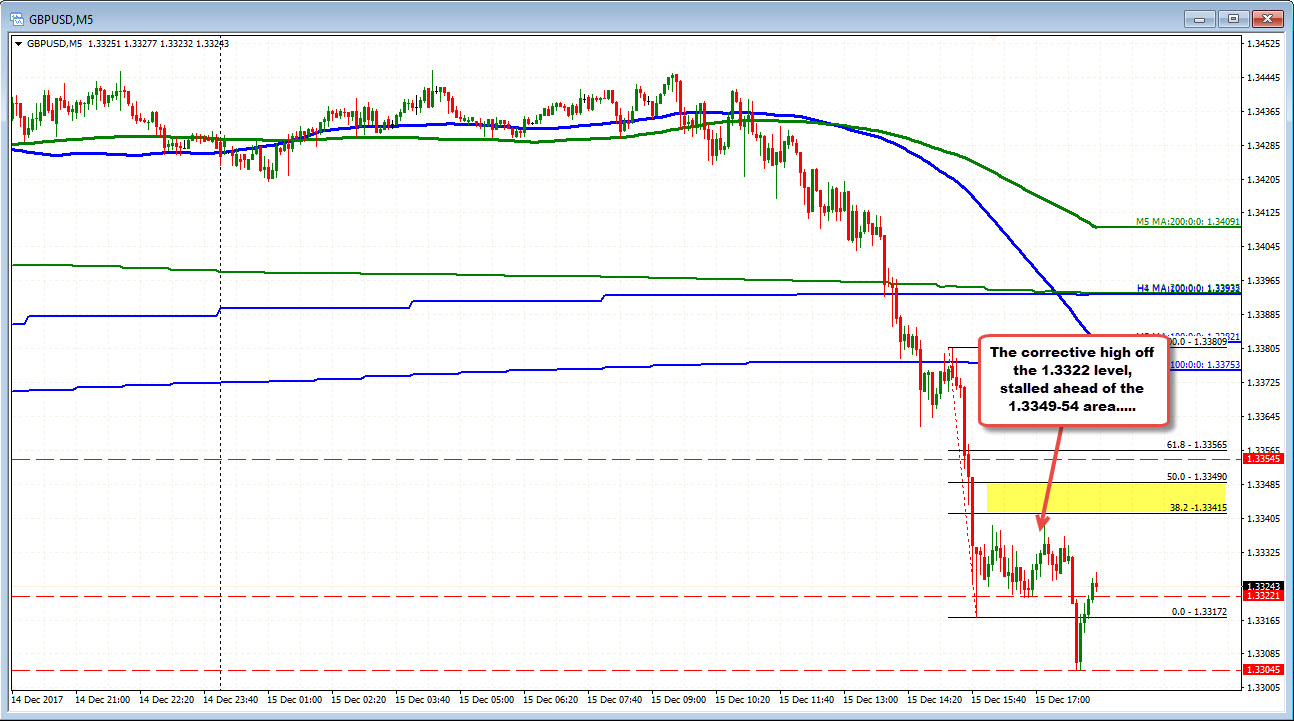

Earlier I spoke about the 1.3322 level. That was a trend line on the hourly chart (see post here). That level started to hold in the NY session, and there was a modest consolidation/rebound. The price moved to a high of 1.3339 - staying below the 1.3349-54 level outlined as a resistance target. The trend sellers stayed in control and a new low was made down at 1.33045.

Looking at the hourly chart below, that low didn't quite make it to the low for the week at 1.33012, nor the 50% of the move up from the November low at 1.32938. That could be a problem for shorts going into the weekend/for the rest of the day.

We are trading back toward the underside of that broken trend line now at 1.3324 (it is a little higher now). A move above - with the knowledge of the low falling short of target - could solicit more buying as we head into the weekend (i.e. some profit taking).

The trend move lower is pretty good today but there is some slowing of that trend for traders.

If you have a longer term mindset, being below the 1.3354 and the MAs (like the 100 hour MA at 1.3375) turned the bias lower today. So if you like the short, it is ok to remain. We may, however see some additional consolidation with support toward 1.3300.