Now what?

The GBPUSD took some steps lower in trading today.

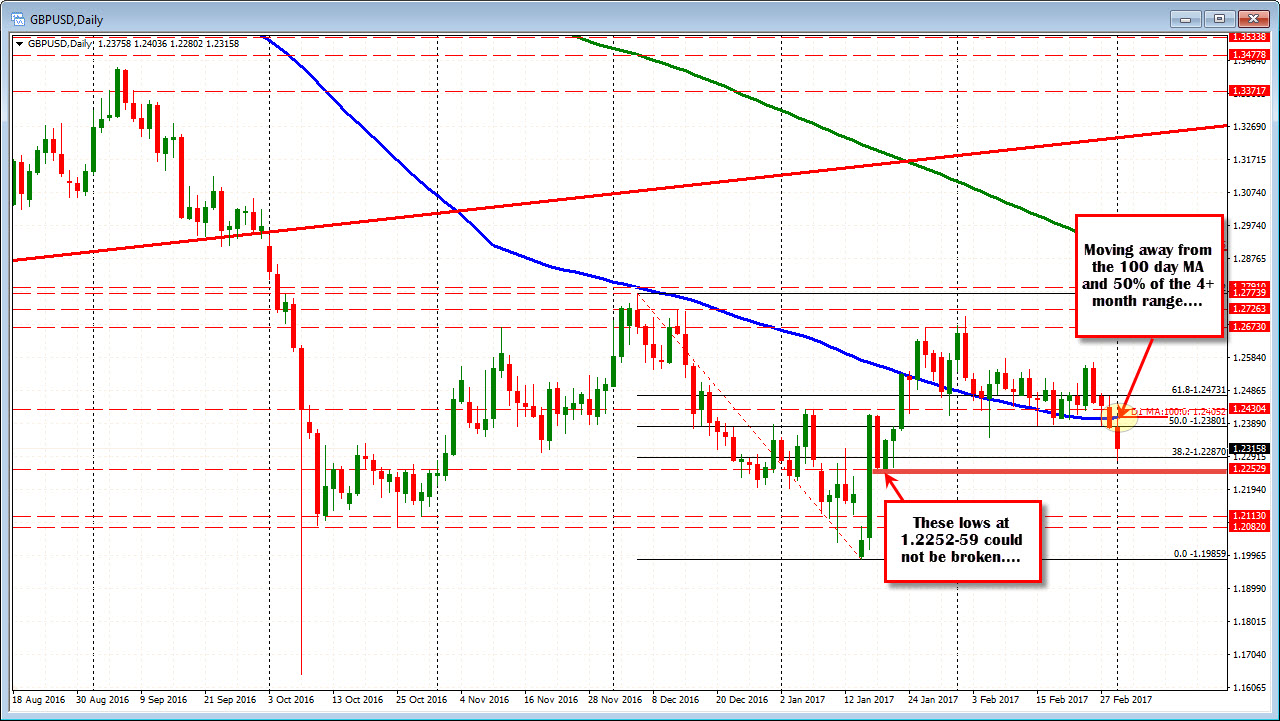

- The first step was to stay below the 100 day MA at 1.2405. The correction during the Trump speech held below that level. CHECK.

- The 2nd step was to get below the swing low area defined by lows on Feb 14/16 and 27. This was a tough step with the first break failing. But it ending up holding below that level and that led to the 3rd step.

- The 3rd step was to get below the Feb 7th low at 1.23468. That line initially held and led to the retest of the 1.2382-87 area. But it was eventually broken and the price came tumbling down....

What now?

Looking at the daily chart, the move away from the 100 day MA is bearish. We also moved below the 50% of the range post the Election day plunge at 1.2380. That is breaish. The three lows between 1.2252 and 1.2259 (Jan 18 to Jan 20) are the next targets to get below. The low reached 1.2280.

Drilling to the 5-minute for clues, the pair has bottomed and quickly moved back higher. There was a spike low at the 10 AM data but that was quickly reversed. HMMMM. Sellers and buyers more balanced. Moreover that low was at 1.2286 which was the old 38.2% on the daily chart (actually 1.2287). So you can surmise, that there is some buying (or less selliing) interest.

Are we racing higher? Not really. We have stalled near the 38.2% of the last trend leg lower, but that retracement is staying nearby. A move above now will look to the 50% and the declining 100 bar MA. A move above those and we will be back to the 1.02346 level from the hourly chart.

Watch the 38.2% at 1.23208 now for intraday clues. Stay below is more bearish. Move above will have traders probing the higher resistance targets.