What would keep the bearish party roaring?

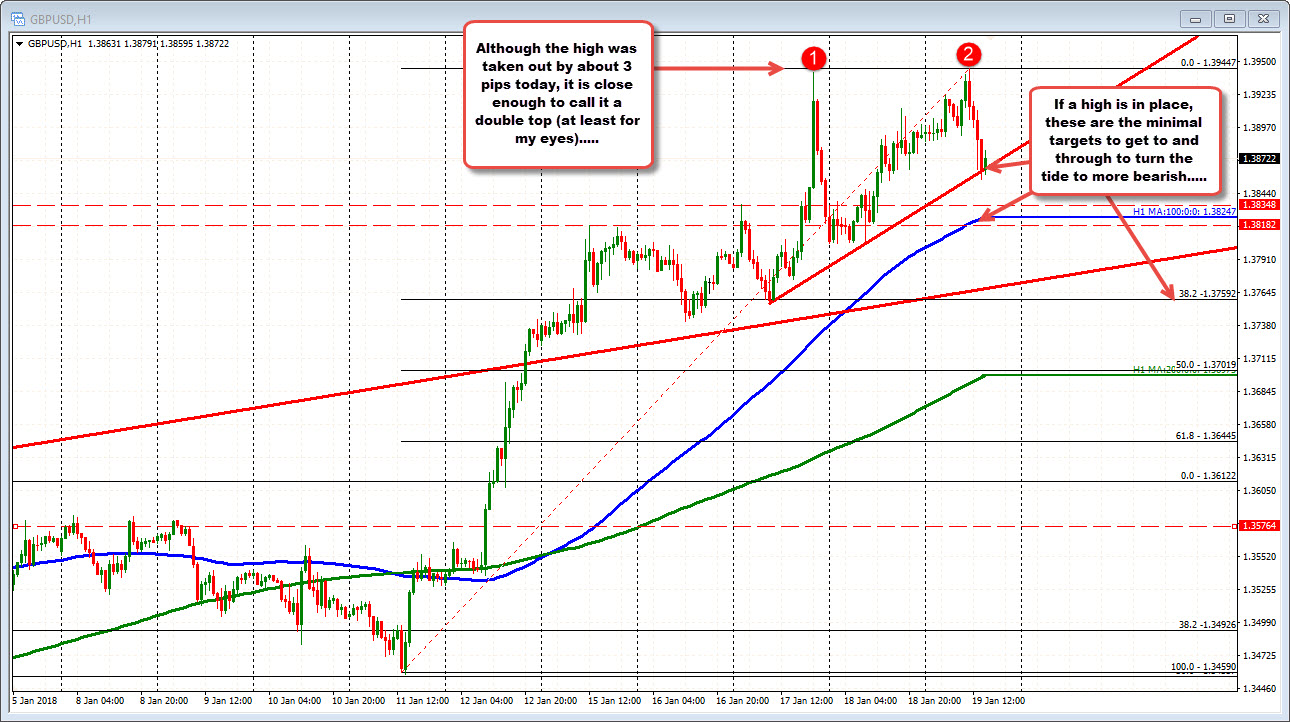

The high on Wednesday in the GBPUSD reached 1.39411. The high today extended above that high to a new post-Brexit high of 1.39447 and reversed. Weaker retail sales helped to push the price away from the peaks (see post on sales here).

Traders will look at the double top (it is close enough for me), as a signal for a top. If so, there are some minimal targets that will help confirm that from a technical perspective.

The price currently is testing a trend line on the hourly chart at 1.3862. There are some buying/stall at the area. That is the first hurdle for the shorts now.

Below that I would look for a run toward the 100 and moving average of 1.38247 (and moving higher). Below that the 38.2% retracement of the move up from the January 11th low cuts across at 1.3759.

Those levels represent a minimum correction if the top is in place (over time - it may not happen today).

What would spoil the "correction party"? That is where is the risk for shorts?

For some traders, a new high now. Double tops are good enough and traders today, may have already jumped on that idea..

With the price 60-70 pips off the highs, is there a interim level that would ruin the bearish party punch today?

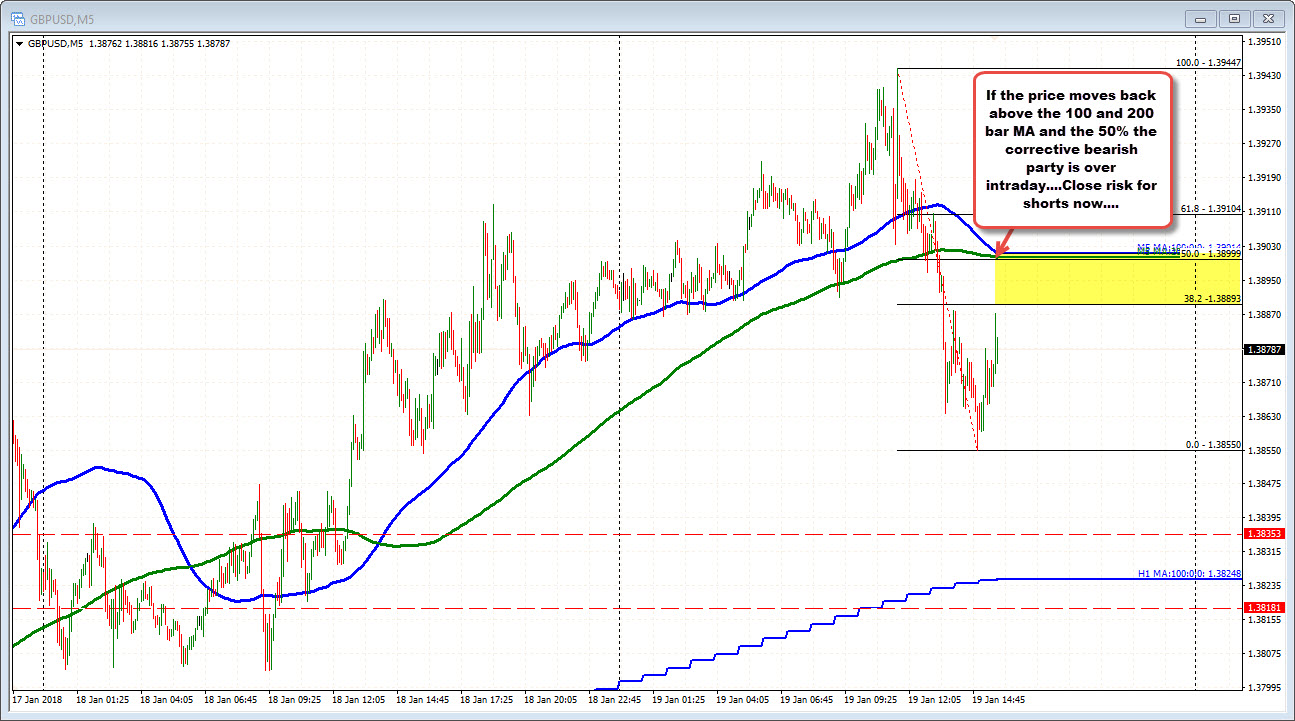

Drilling to the five-minute chart below, the 100 and 200 bar moving averages (blue and green lines) on that chart were broken on the way lower today. That is bearish. Both those MAs are turning back lower (the slope is down), and near converged levels at 1.3901. The 50% of the days trading range comes in at 1.38999.

So that area around the 1.3900 is a dividing line intraday for bulls and bears. Stay below and the bearish party continues. Move above and the party is breaking up.

Of course dollar bearishness from the Washington debt saga could be an issue. However, they tend to find a solution so the tide could turn too. With risk defined it might be a good trade for a trade and continuation of the bearish corrective party.