Dollar pushed and pulled

The USD has moved higher against the EUR, and GBP. Better data out of the US is helping the greenback. Against the CHF, the pair benefited from the Swiss finance minister official saying a new cap should be established vs the EUR (reallly???) That story is now being refuted. The USDCHF is up and down on the headline. The USDCAD has moved lower on the back of no change in rates by the Bank of Canada and a less dovish tone in the statement.

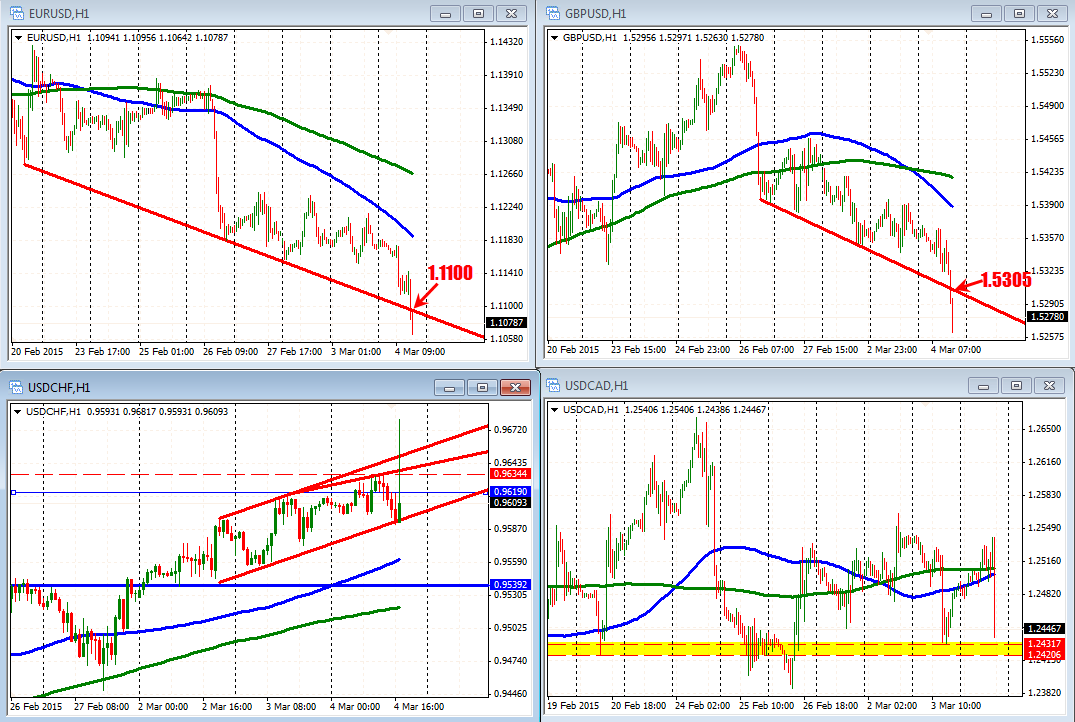

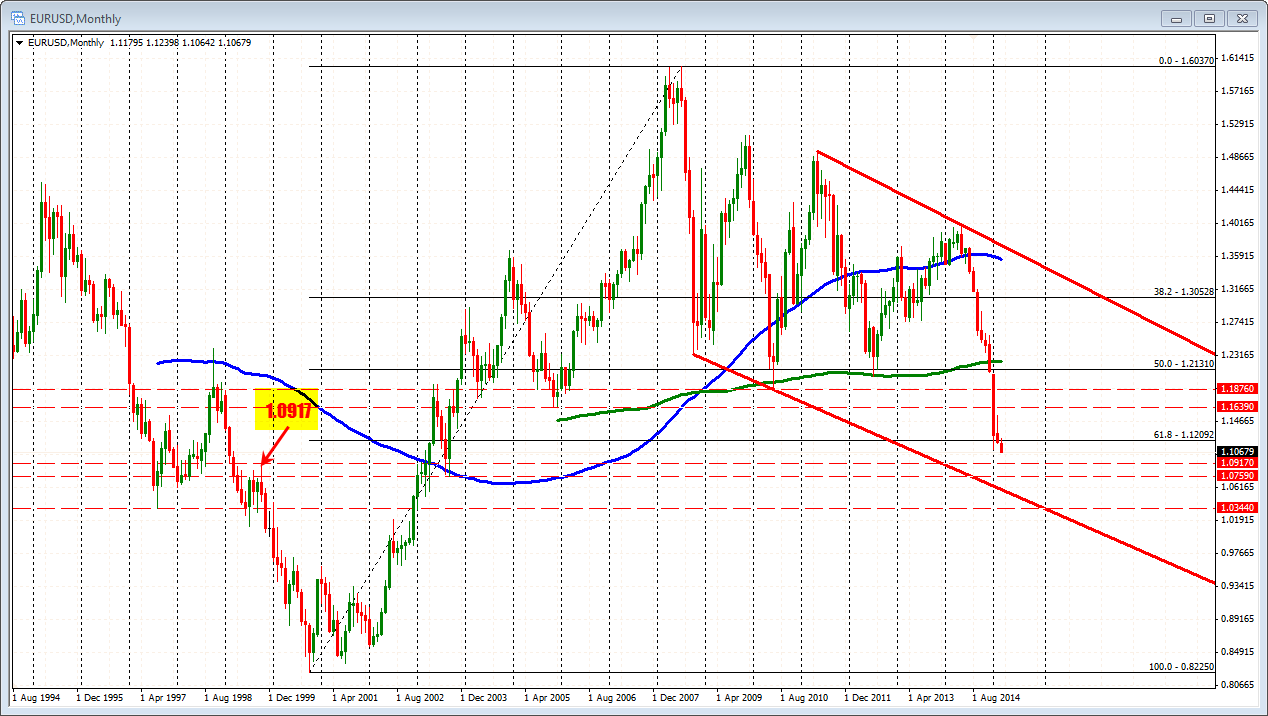

The EURUSD fell below trend line support at the 1.1107 level and also below also the low for the year at 1.1068. The low extended to 1.1064 (so far at least). Needless to say the pair is sitting on a knifes edge. Stay below 1.1100 now and the bears remain in control. The next target? 1.0917 which is the the swing high going back to October 1999 (see chart below).

The GBPUSD has moved below trend line support (at 1.5305 currently) and is approaching key support against the 50% retracement at 1.5250. This is the 50% of the move up from the 2015 low to the 2015 high. If the bears are to remain in control, 1.5300 should hold corrections.

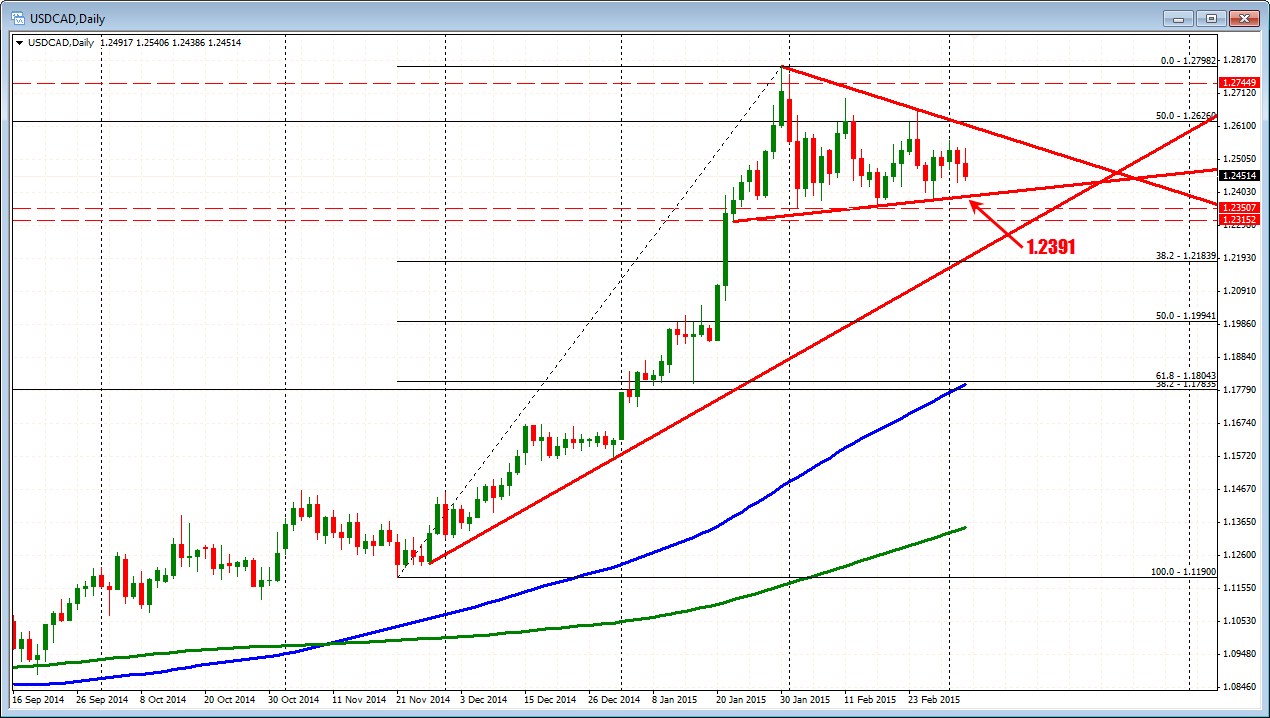

The USDCAD has support at the 1.2420-1 2430 area. These are a series of lows for the pair over the last month. Resistance above is at 1.24788 (38.2% of the range today) up to 1.2489 (50%). On a break of the 1.2420-30 area and the pair will next target 1.2391 area (see daily chart).

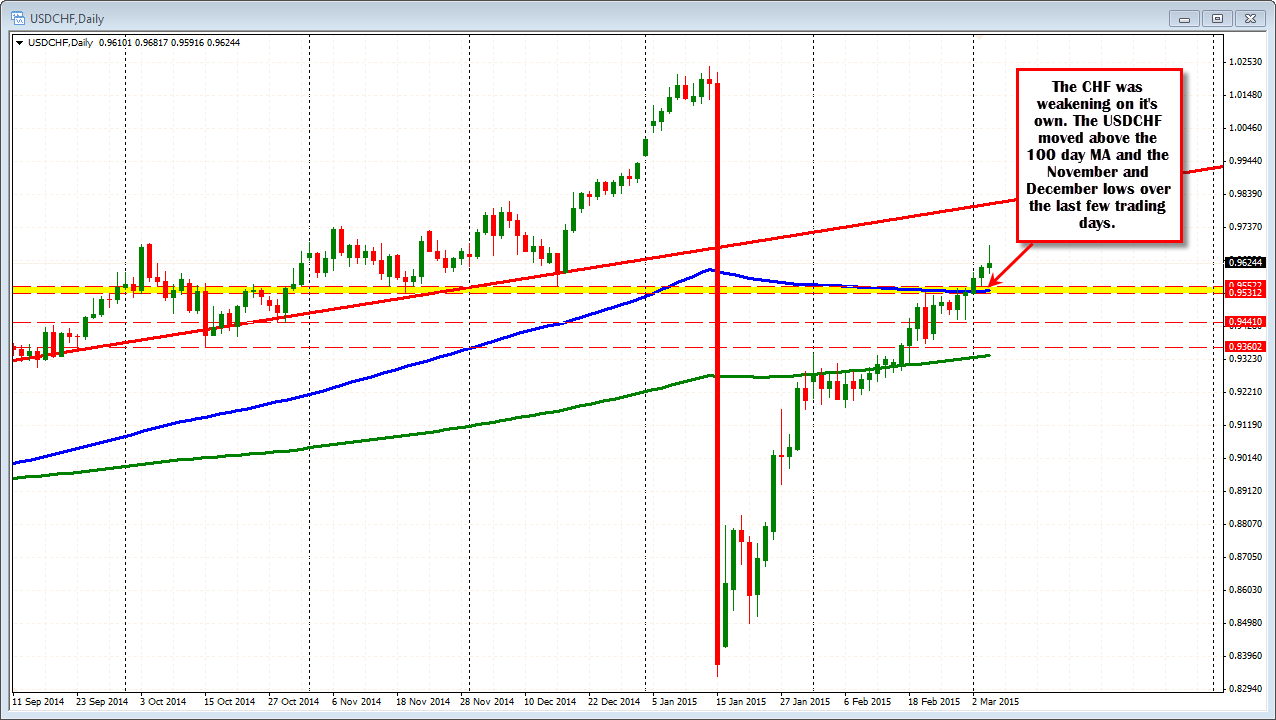

The USDCHF has just had a report that refuted the Swiss finance ministers comments and the price is now falling back lower after spiking higher on the comment. If the comment was not made, the CHF has been weakening on it's own. The price moved above the 100 day MA and the November and December lows over the last few days. Now if there is liquidation the daily chart will look top-ish.

The forex market are on the move.