BOC will keep rates unchanged.

Although the BOC will keep rates unchanged when they announce their latest rate decision at 10 AM, the market always has the potential to move one way or the other dependent on the interpretation of traders. For this pair OPEC is also on deck for Thursday with cuts expected to be extended. The price of oil has been a help for CAD as it has recovered to above $51.00. It currently trades at $51.25 down -$0.21.

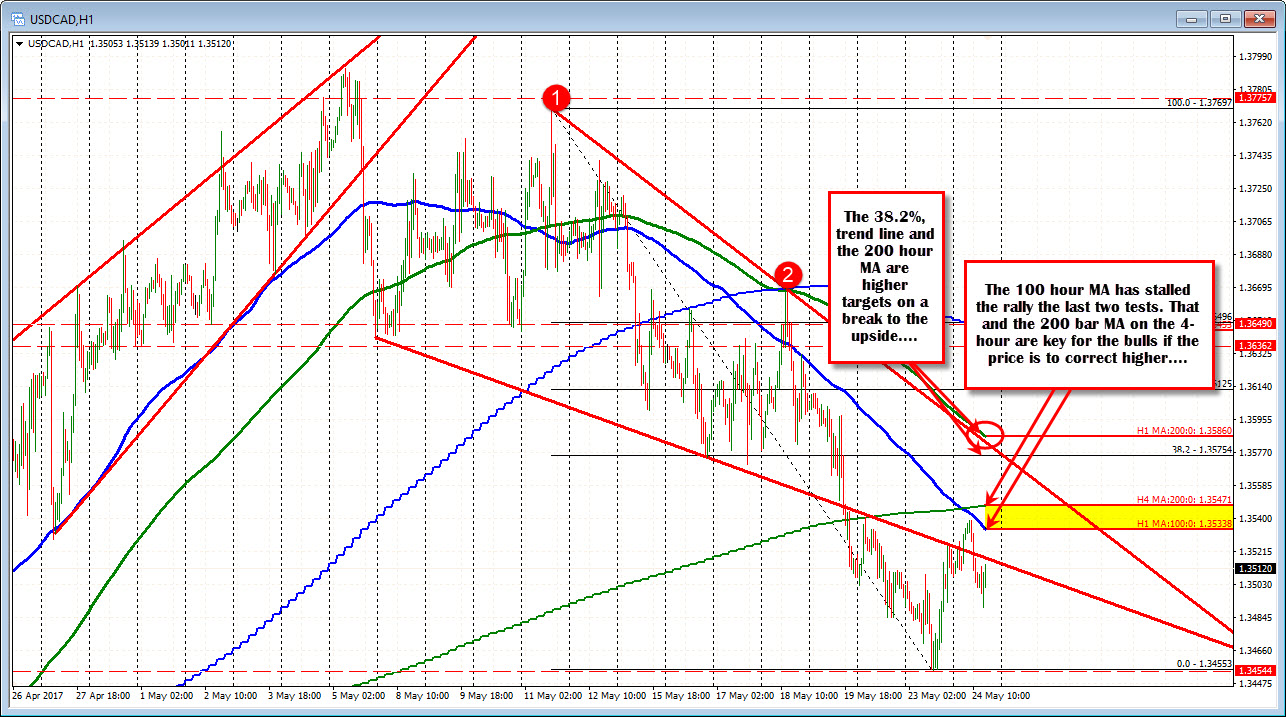

Technically, the pair has been paying attention to technical levels. Looking at the hourly chart above, today, the 100 hour MA has stalled the rally (blue line in the chart). At the high the MA was at 1.3542. The high price reached 1.3539. The current MA is at 1.35338 and moving lower.

A move above the 100 hour MA has the 200 bar MA at 1.35465 as the next (and close) target (green step line in the chart above). The last time that MA was tested (on Monday), sellers leaned against that level

On the topside, the 1.3535-465 represents the level that needs to be broken above to give the pair a bigger push in the upward direction. If broken, look for a move toward the 1.3575 and then the 200 hour MA at 1.35869 (and moving lower).

On the downside, the 1.3554 level was the low from yesterday and also a level that had swing levels going back to early April (see chart below). A move below that has the 61.8% retracement at 1.34393 as the next target and then 1.3400-08 area..

SUMMARY: The price is hanging a little lower on the day but is contained. We trade near the middle of the weeks trading range, are keeping more of a bearish bias below the 100 hour MA, but the statement nuances can change the bias. The price action and technical tools will tell the story of how the market traders are feeling. Watch that 100 hour MA/200 bar MA on the 4-hour chart above and watch the 1.3455 below for new bias /directional trading clues.