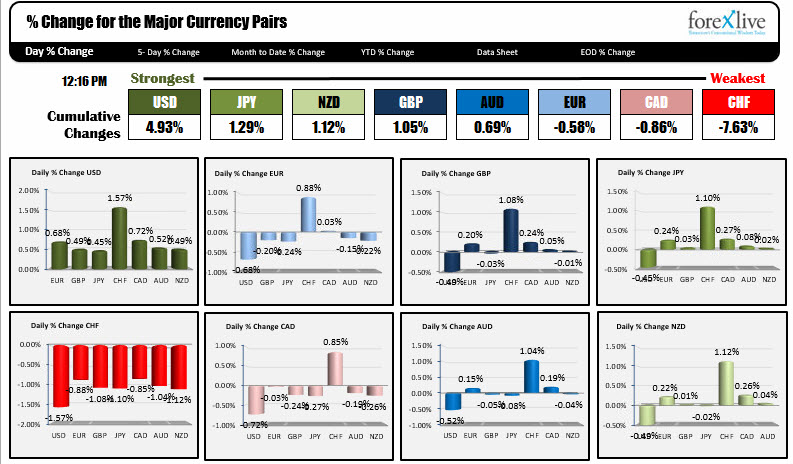

CHF is the weakest currency of the day.

The USD is higher and the strongest currency today.

On the other end is the CHF. It is the weakest and in a way is outperforming the USD's move.

With the USD the strongest and the CHF, the weakest, the USDCHF is the biggest mover. It is changed by 1.57% on the day.

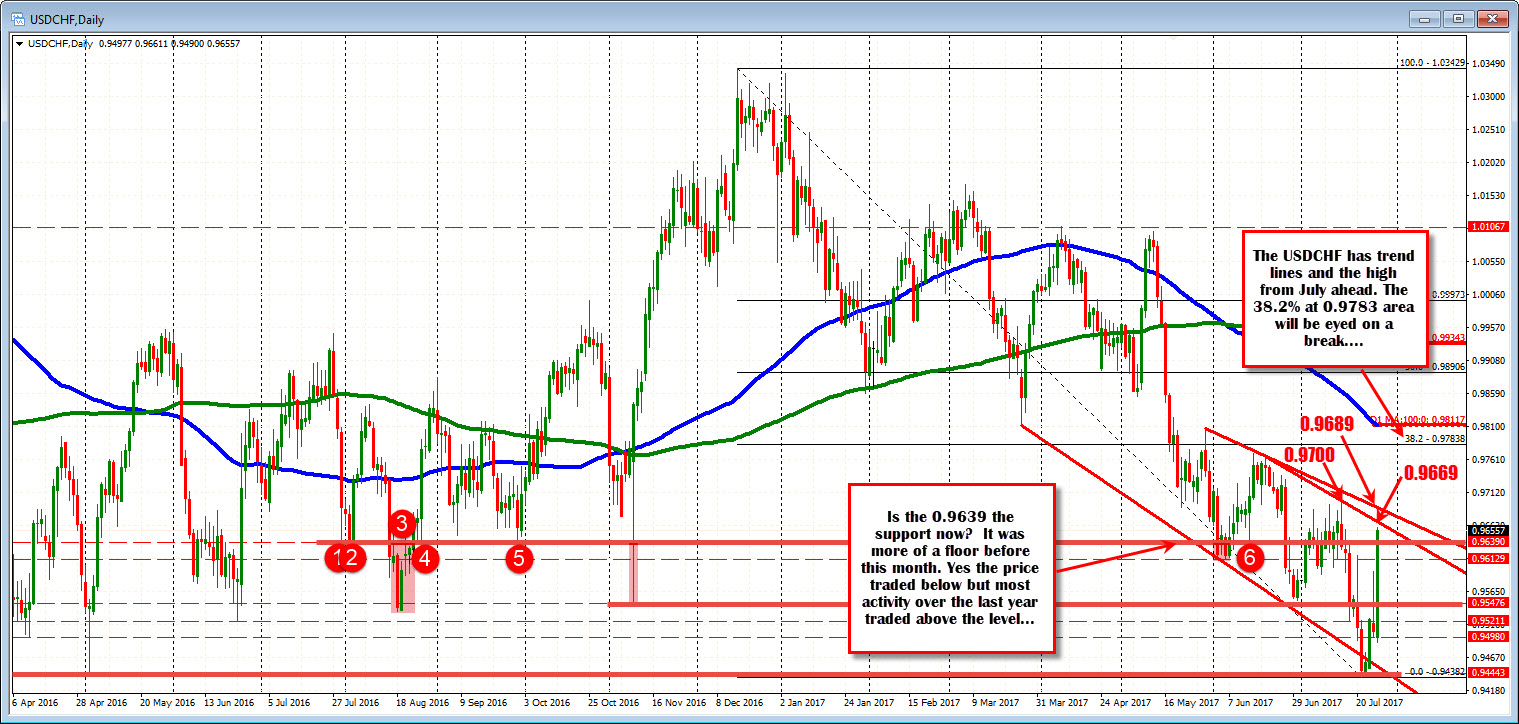

Technically, looking at the daily chart, the pair bottomed on Friday near the low from May 2016. It surged on Tuesday. Yesterday was a tale of two central banks. The early hours were focused on SNB and potential intervention. The afternoon was dominated by the dollar selling.

Today, the SNB might has been "involved" again (not confirmed), but the dollar is not weak today. It is higher across the board.

The run higher today, sees the price moving back above the swing low levels from 2016. They are represented by the horizontal lines on the daily chart above. The high red line at the 0.9639 prior to the last month, seemed to be more of a low going back to early August 2016 (see red circles). The last month has seen the price move more above and below that line (at least earlier in the month). The price is back above the level. That level at 0.9639 is now close risk level for the pair.

On the topside - staying on the daily chart - the price is approaching trend lines at 0.9669 and 0.9689. The high from July reached 0.9700. Those are the next targets to get to and through now. Above those levels and the 38.2% retracement at 0.97838 will be eyed.

What does the surge look like on the hourly chart?

The pair had a huge up and down yesterday. The 100 bar MA on the 4-hour held resistance, then the 100 hour MA held on the downside.

Today the price broke above the 200 bar MA on the 4-hour chart at 0.9588 (currently) and the 200 bar MA on the 4-hour chart at 0.9633. We currently trade in a consolidation area from earlier in July. The 0.9690 area is a resistance target on the hourly chart (38.2% and swing levels). That dovetails resistance on the daily chart as well. Key target. Overall the price action today is quite a move.