Forex technical analysis: USDCHF remains between MA levels February 27 2015

SNB's Moser said the CHF remains "massively overvalued" (not just overvalued, but massively overvalued), but the USDCHF remains contained.

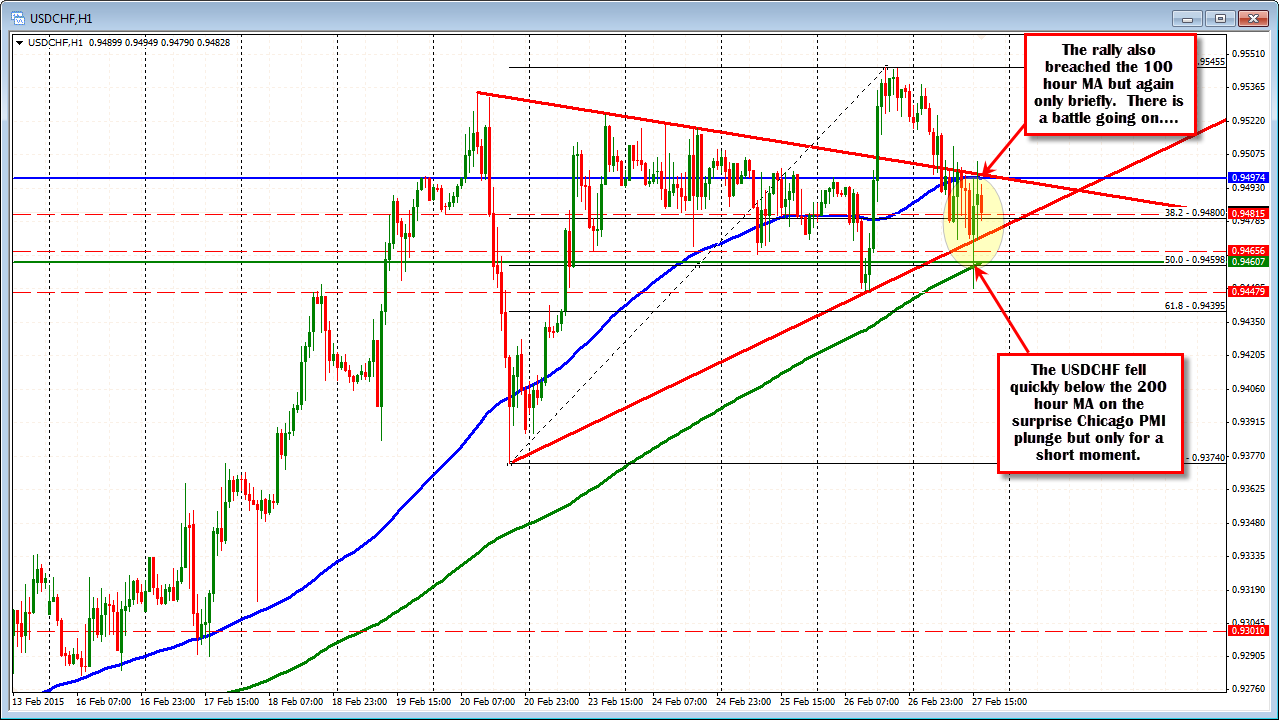

Looking at the hourly chart, the price did dip below trendline support, and the 200 hour moving average (green line in the chart above) after the massively lower Chicago purchasing managers index (45.8 vs 58.0), but that move was quickly reversed, and support reestablished against the trend line on the next hourly bar.

On the topside, the 100 hour moving average was also pierced on the post Chicago PMI rally, but it too failed and reversed back to the downside.

So technically speaking, there is a intraday battle going on between the buyers and the sellers in trading today. When there is a battle, it is time to either trade the range or look for a break outside this range. My preference would be to expect the the buyers to defend the 200 hour MA on the downside (risk for longs), with a break higher at some point but that may not happen until next week. Patience.

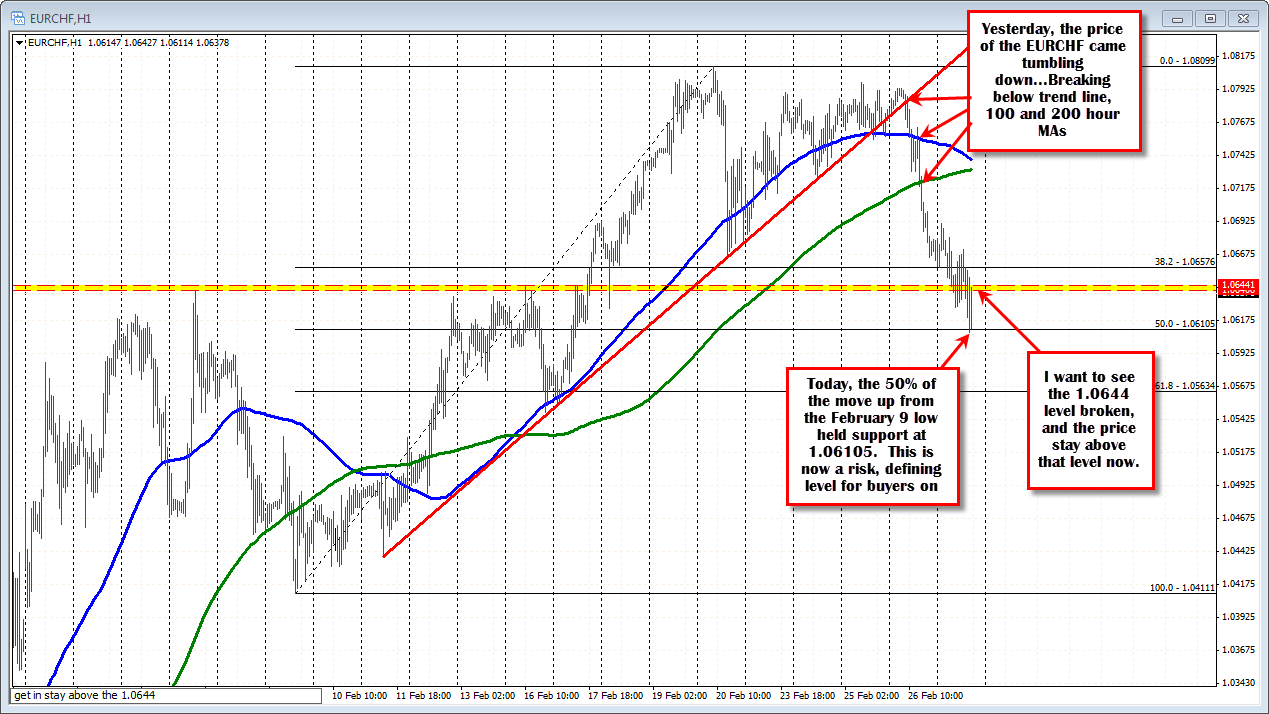

Looking that the EURCHF, the pair tumbled with the EURUSDs sharp fall in yesterday;s trading and as a result of some technical levels being breached (trend line, 100 and 200 hour MAs - see chart below).

That move was extended in trading today. However, the pair has found support buyers against the 50% of the move up from the February 9 low to the February 20 high. That level comes in at the 1.06105. The low today came in at 1.06089. Nice test and hold at that borderline level.

Going forward, I will be looking for that 50% level to now become a stronger support. On the topside, if the price can now get in stay above the 1.0644 level, we should see further upside potential/momentum.