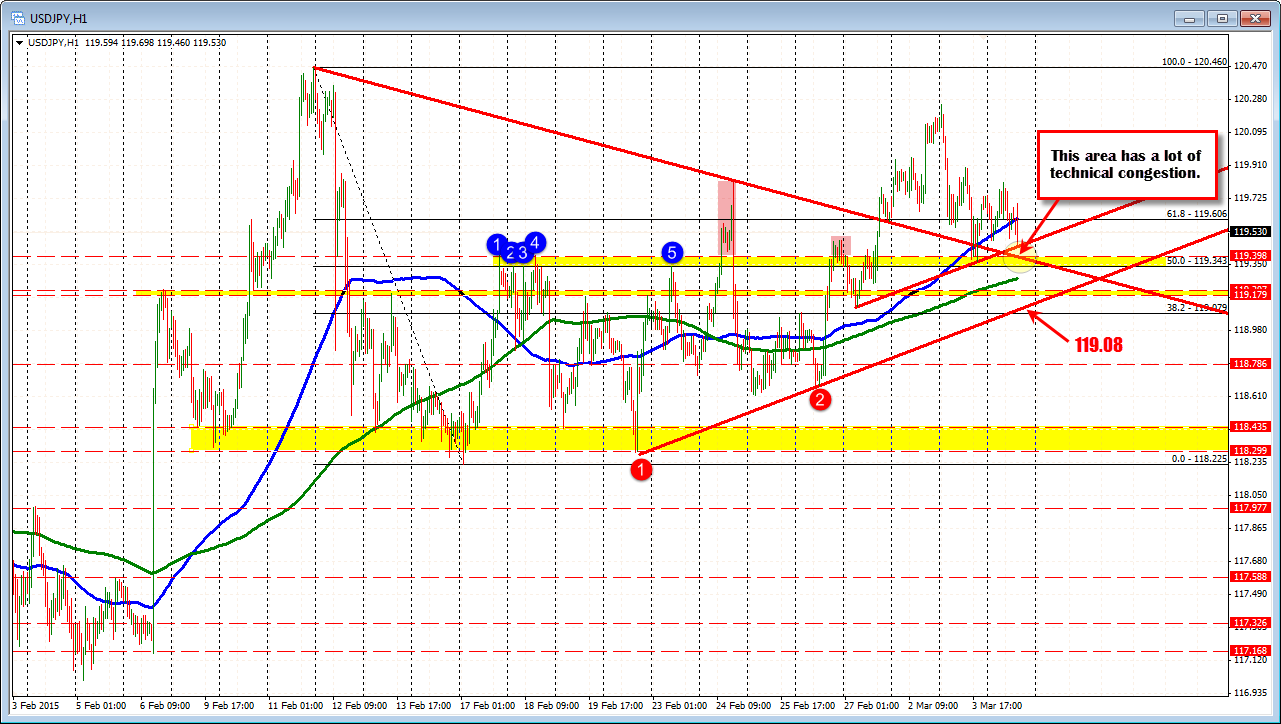

The 119.34-45 has a cluster of technical levels

Trend lines criss-cross.

Swing lows and highs.

The 50% of the move down from the high to the most recent low (at 119.34).

There is a number of support below at the 119.24 to 119.45 area.

The low after the employment report moved to 119.45. The price has bounced modestly.

If the price can stay above the cluster of support below, the buyers remain more in control. ON a move below, the chance for further downside back filling increases with the 200 hour MA at 119.27 and the lower trend line at 119.08 (currently), the next targets.

The close from yesterday came in at 119.713. The high after the ADP came in at 119.695. A move above this area, should solicit more buying.

Fed Evans speaks on the economy and monetary policy next (at 9 AM ET). Governor George speaks at 1 PM. The Markit service and composite indices will be released at 9:45 and the ISM non manufacturing at 10 AM ET. Later at 2 the US Beige book will released. Buyers are holding on to support below. Can it now get the push/break it needs?