Extends the range to the upside.

The Durable goods orders were mixed with the headline and pieces and revisions. The question I ask is the Durable preliminary gets revised in the Factory orders and then got revised again with this release. Some of the revisions were still pretty significant.

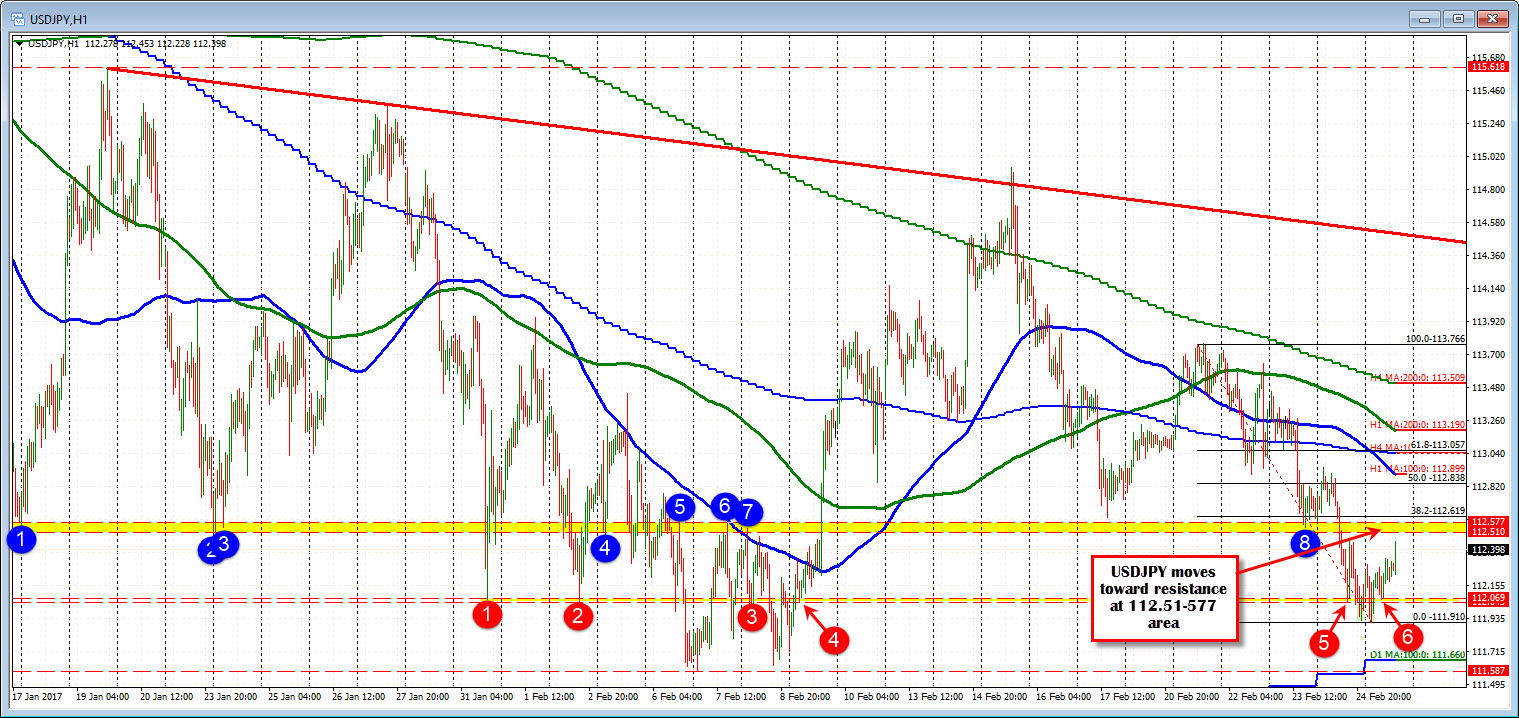

Technically, the USDJPY has extended a narrow trading range of 43 pips to 58 pips. THe 22 day average trading ranges is 109 pips for the pair (the average for the last month or so of trading). The pair has approached the 112.51-577 area which is home to a number of swing levels. On Thursday last week, the pair stalled at the level. On Friday, that area was broken and the price moved away. If the sellers are to remain in control, that area should find sellers on the correction. The high on the spike stalled at 112.488 after the data.

NOTE: The 112.04-07 is another area where there has been a number of swing levels (ahead of the 2017 low at 111.587. ON Friday, there was a swing low at that area. Today there was a swing low at the area (red circle 5 and 6). Admittedly, the market traded below the level too, but keep an eye on that area if there is a dip toward it. Be aware. If you like a rebound in the dollar, that is a risk level for longs on dips.