CPI data due from the UK at 0930 GMT, some quickie previews

Barclays:

- We expect the unemployment rate to be unchanged at 4.4%. The marginal decline in January's claimant count remains consistent with the current rate. Core earnings growth is likely to accelerate mildly. Wage pressures indicated in recent surveys are likely to feed in with a lag over the coming months.

RBC:

- Average earnings growth for January looks set to have risen to 2.6% 3m/y, continuing the steady upward trend on the exbonus measure that has been in place for the last year. Nevertheless, this would be consistent with a loss of momentum in the quarter-on-quarter growth rate in pay, before the annual rate has had a chance to make a break out of the 1.8-2.7% 3m/y range that has prevailed since September 2015. Even if the gain in employment is a bit less than the 88k 3m/3m change last time, evidence of some further expansion in labour market activity is likely to be sufficient to result in a Bank Rate hike by the MPC in May. The unemployment rate rose from 4.3% to 4.4% last time and on balance we look for it to hold at 4.4% this time but would not be that surprised to see 4.3% either.

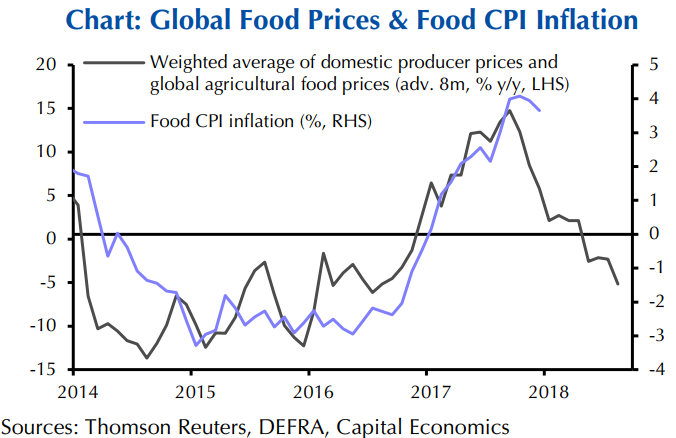

Capital Economics:

We suspect that CPI inflation will fall back in February, in what should be the start of a sustained downward trend this year ... we have pencilled in a fall in CPI inflation from 3.0% to 2.8%

- the peak impact of sterling's past depreciation should now have passed

core goods inflation (i.e. excluding food, fuel, alcohol and tobacco) should ease too

- we expect core inflation to drop back too, from 2.7% to 2.5%