Hike was expected

- says board was not unanimous on rate decision

- balance of risks to inflation has deteriorated

- hiking key rate because simultaneity and magnitude of shocks affecting inflation

- inflation panorama has become more complex

- main goal of board is to maintain inflation expectations

- convergence to 3% target will be slower than previously anticipated

- one board member voted for 50 basis point rate hike

- inflation will reach levels close to objective at end of next year

- inflation hit by unforeseen shocks

- challenge to keep CPI out look anchored in mid-long term

- due to intensification of risks to inflation for the right to act as soon as necessary

- annual inflation for 2017 higher than figure for November

The USDMXN has move lower today.

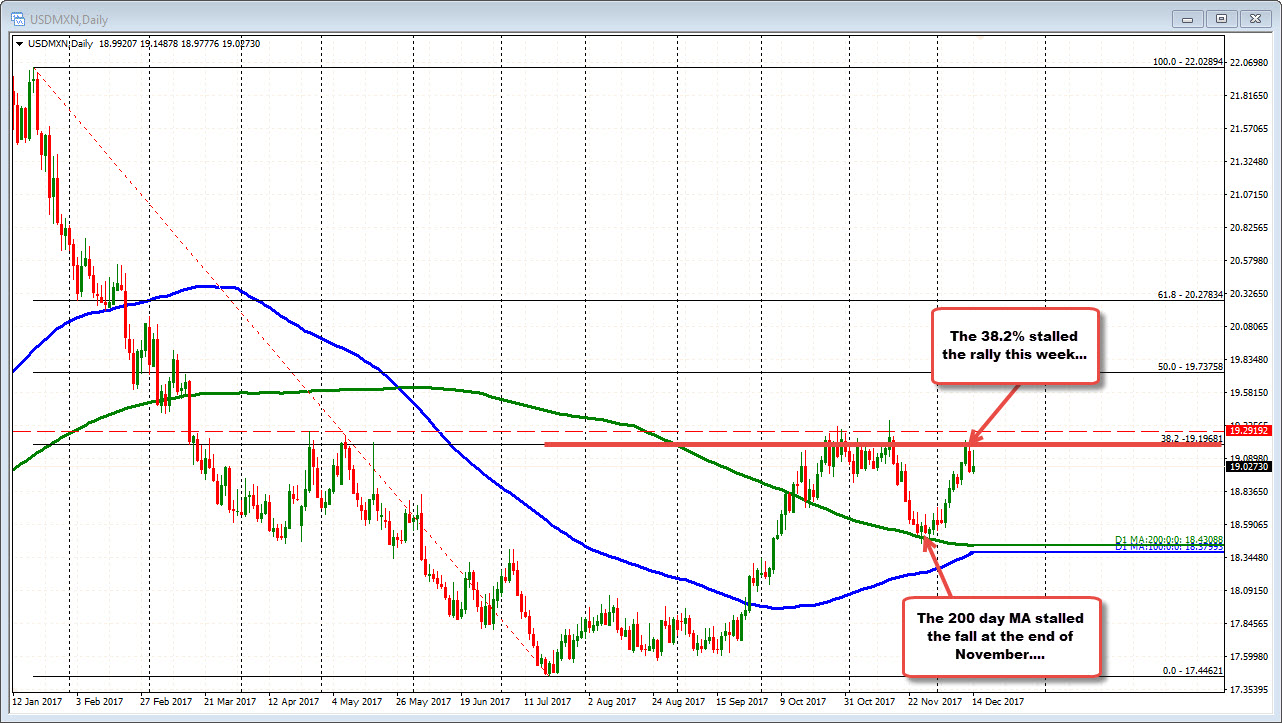

Looking at daily chart, the pair moved up from the 200 day MA (reached toward the end of November - currently at 18.43088) and stalled near the 38.2% of the move down from the 2017 high (at 19.1968).

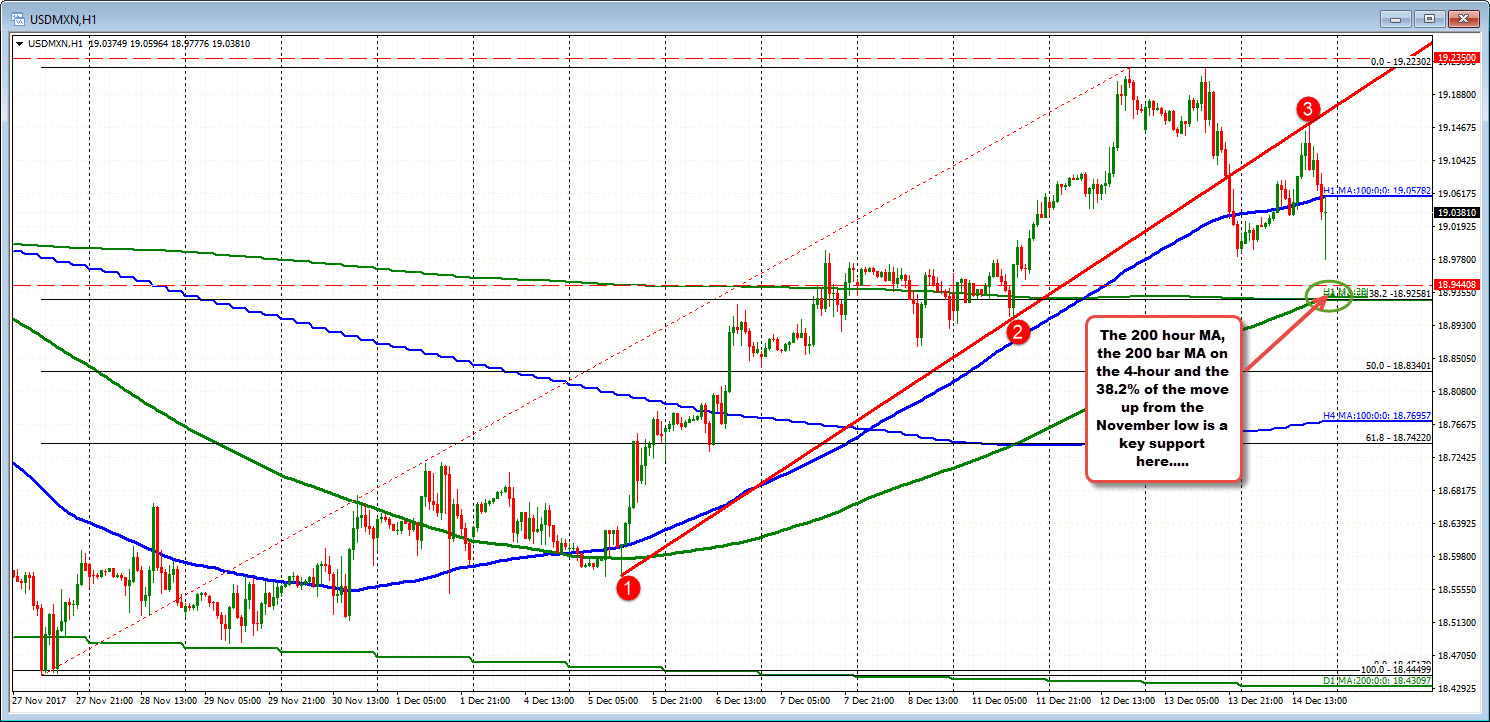

Drilling the the hourly chart below, the pair has moved below the 100 hour MA (retesting now). If the pair is to move lower, staying below that 100 hour MA will be the barometer for the bias.

A key level to get below is the 18.9258 area. At that level, the 200 hour MA, the 200 bar MA on the 4-hour chart, the 38.2% all converge in that area. Moving below that level will be needed to increase the bearish bias.

For now though, traders will need to keep the price below the 100 bar MA.