The pound speaketh and all shalt listen.

Just shy of a 300 pip round trip is like the cable of old. It either slaps a brand new Jag on your desk or rips the shirt off your back and the fillings out your mouth.

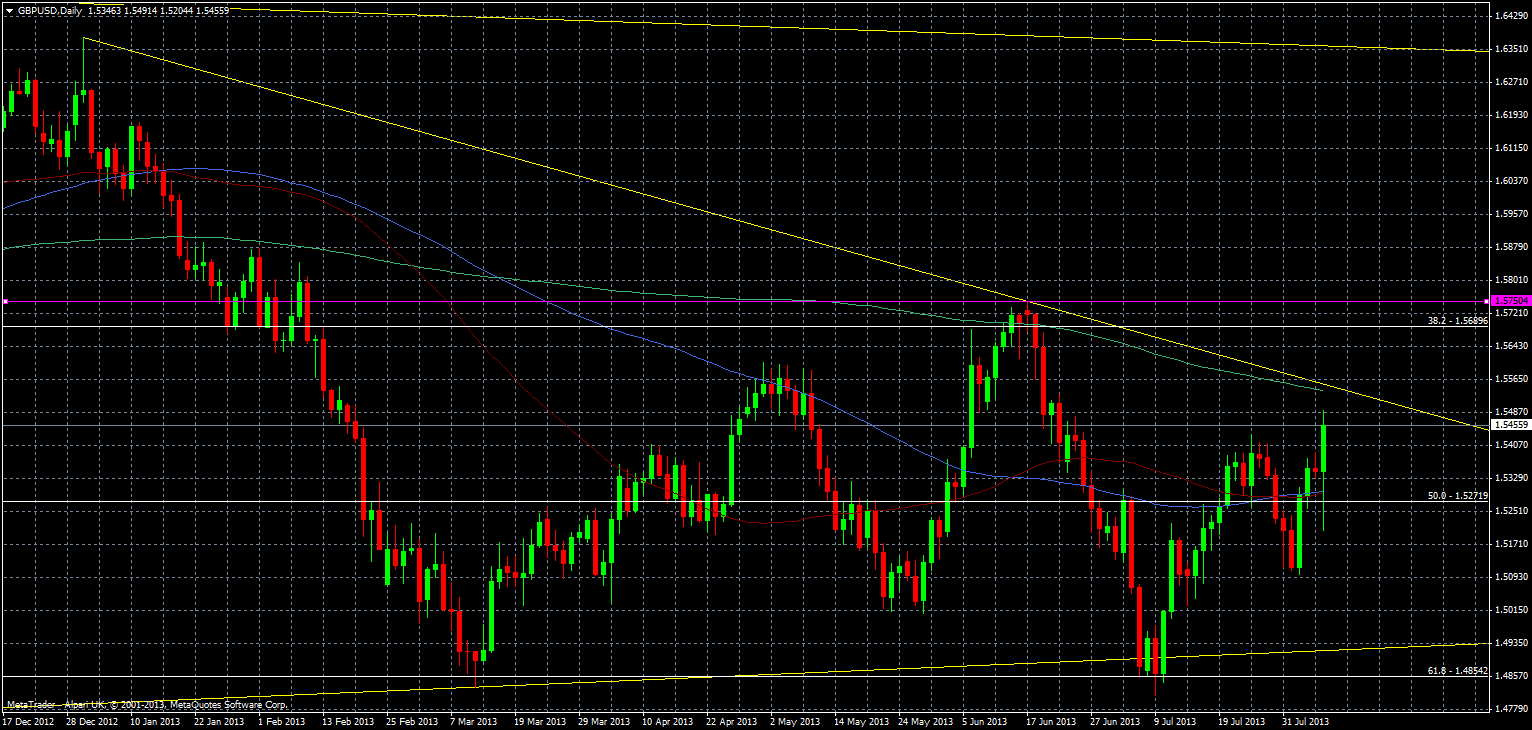

1.5492 is the high so far today and that was bang into strong resistance at 1.5488. This is a very strong level of technical resistance. Naturally I expect there to be resistance at 1.5500 and Mike has listed options and orders there already.

The thing with cable is that even after such a big move it can suck you in to a false sense of security and hit you again. Even though we’ve drifted back to 1.5455 there is a risk that it smacks higher again. If we break 1.55 then the next levels to look at will be the 200 dma at 1.5535 and the Dec 2012 trend line.

Time will tell whether this move is sustainable and we can expect some volatility while the market decides which way it wants to go. My view is that the inflation meeting wasn’t a game changer in real terms. Monetary policy has been stated and we are likely to go back to the dollar trade, but for now it’s still about the pound.

My summer range top was 1.5500 and I’m toying whether to keep that view or raise it. As always the price action will dictate my final decision.

We took out virtually all the technical support on the way down and the majority of resistance on the way up. In the first instance look for broken resistance levels to become minor support. The moves would have cleared a lot of the market so it may take a short amount of time for this to establish once again. Here’s my earlier tech levels Technical levels 7 August which you can use to calculate the new support points. Don’t hang you hat on them but keep them in mind.