Maybe not so upbeat.

The EURUSD is the trading story as Draghi presser continues. The ECB did not discuss removing the easing bias in interest rates. The market is a bit disappointed with that.

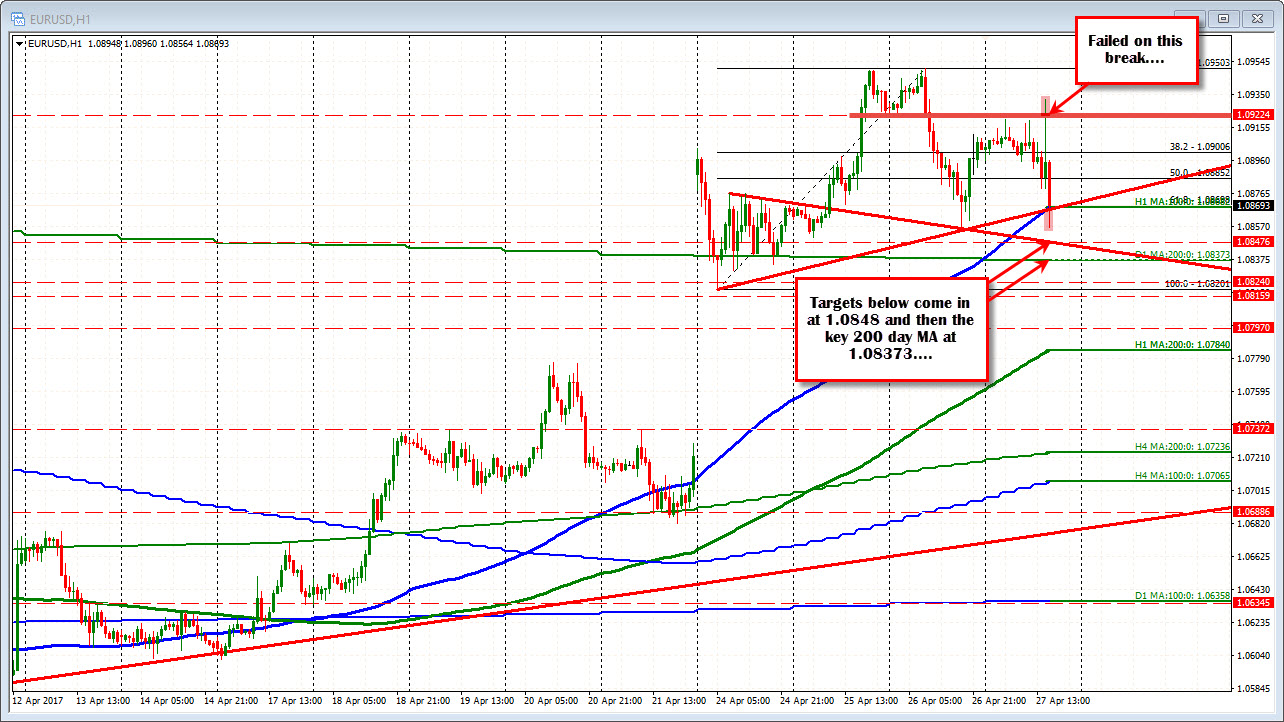

Technically, the pairs moved above the 1.0900-10 area and then the 1.0922 level could not be sustained. Buyers turn to sellers.

The German 10 year yield trades down to 0.327, down about 2.5 bp. Other European yields are down and trading near lows. The European stocks are wilting a little as well.

The EURUSD price has moved below its 100 hour MA at 1.0868. The low has reached the low from yesterday at 1.0855 and bounced back to the 100 hour MA level. Will the bears keep control.

A lower broken trend line comes in at 1.0848. The key 200 day MA is at 1.0837. They are the next downside targets for the pair on continued weakness.

Market risk remains elevated.

PS over in the EURGBP, the pair is moving below its 200 hour MA at 0.8438 and trades at new week lows. The 0.84204 is the 50% of the move up from the April 18th low.