December 18, 2017

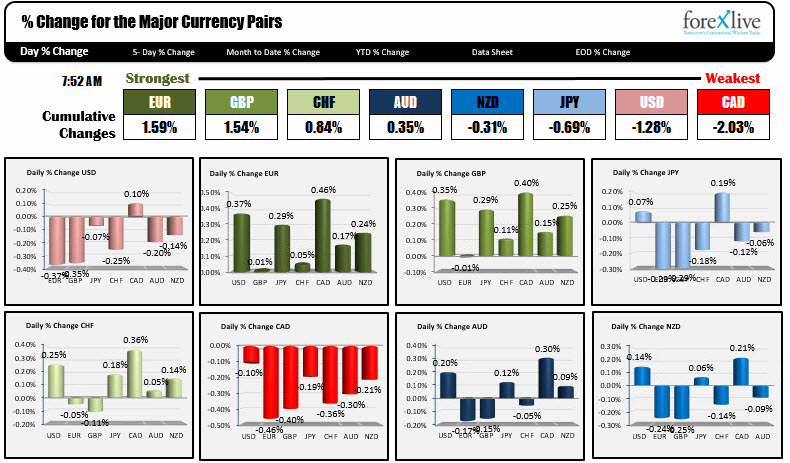

The EUR is the strongest, while the CAD is the weakest as NA trader enter for the week. The USD is more negative with gains only against the CAD. The greenback is little changed vs the JPY (on the downside). It is down the most vs. the EUR and the GBP as both those currency pairs see a rebound after Friday's falls. The EURUSD is back above converged 100 and 200 hour MAs at 1.1779. The GBPUSD is up testing its 100 hour MA at 1.33734 and stalling. The 200 hour MA is above at 1.33837 currently and will be another hurdle to get to and through.

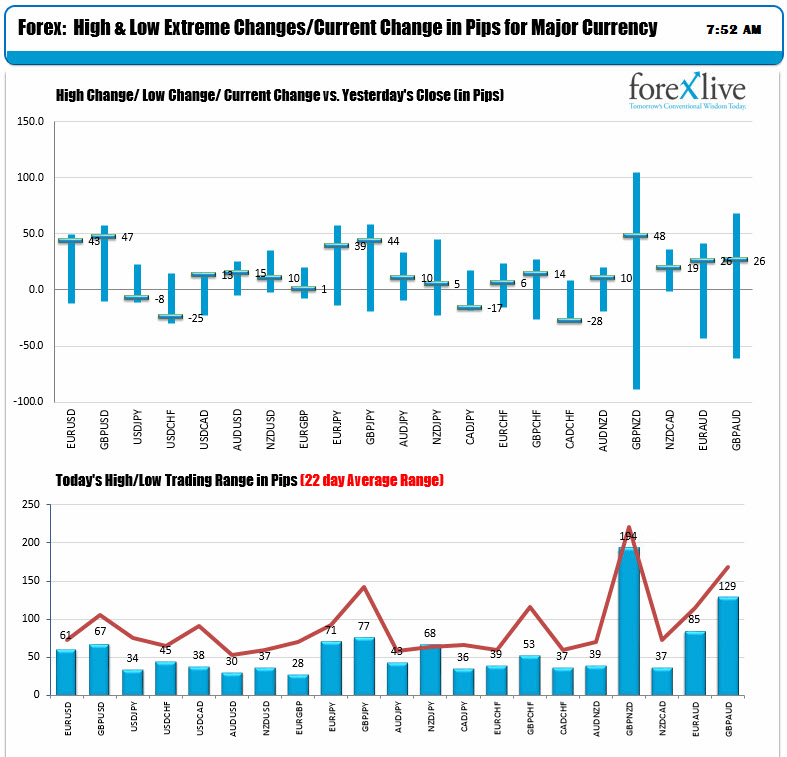

The ranges for the major pairs are somewhat muted (although the EUR and GBP are having decent days for December 18th). The dollar pairs are mostly trading near the dollar lower extremes as well as NY trader enter.

IN other markets a snapshot shows:

- Spot gold is trading up $4 or 0.32% at $1259.50

- WTI crude oil futures are trading up $.34 or 0.59% at $57.64

- US rates are trading a bit higher: two-year 1.8483%, +1.2 basis points. Five-year 2.1723%, +1.8 basis points. 10 year 2.3709%, +1.7 basis points. Thirty-year 2.6995%, +1.2 basis points

- US stock futures are up smartly in premarket trading: S&P index is higher by 10 points. Dow futures are up 150 points. Nasdaq futures are up 32.5 points. They are cheering the expectations of the tax reform final vote going through as early as Tuesday.

There is nothing big on the economic calendar:

- At 8:30 AM ET/1330 GMT, Canada's foreign securities purchases will be released. No estimate. Last 16.8 1 billion

- At 10 AM ET/1500 GMT, the NAHB housing market index for December is expected to remain unchanged at 70

Focus will likely be on the stocks.

Focus is also on my father's birthday today. Not only a great father but a trading mentor too. HBD Dad.