A preview of the ECB meeting on January 25 2017, via RBC

The RBC note is a detailed one, this is a summary only, any bolding is mine

Changes are coming but not just yet

- Despite the message from the accounts of the December meeting that the ECB would consider changes to its forward guidance 'in coming months' we don't expect any major announcements at its meeting next week (Thursday Jan 25th).

- Those meeting accounts have been the main event since the Governing Council last met. The reference to changes to the forward guidance came as a surprise to the market. However, as we pointed out, the shift was in line with the increasingly hawkish voices that had been emanating from the Governing Council since the open-ended QE extension announced at the October meeting.

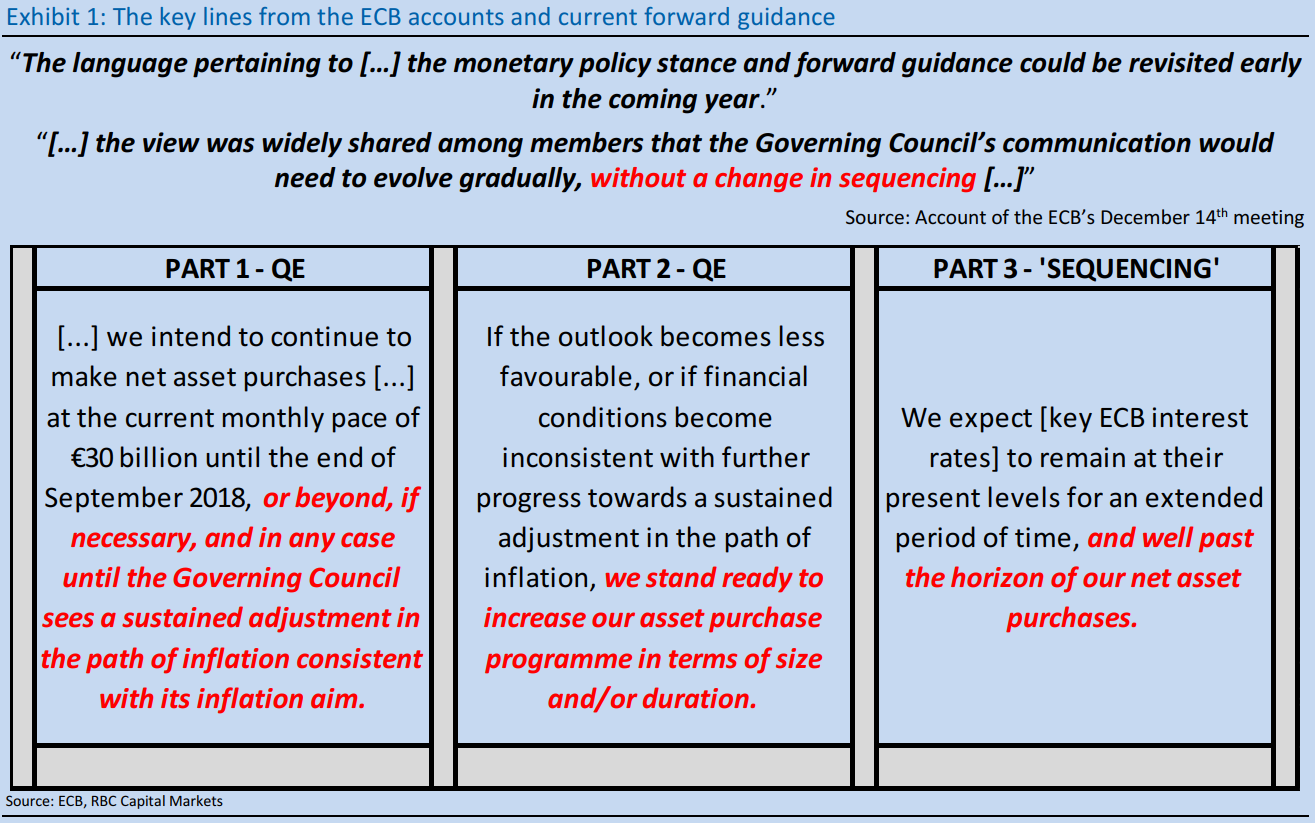

- Clearly, changes to the language are coming though it's difficult to pinpoint when. We would, however, highlight one thing that was somewhat overlooked in the reaction to the minutes. As well as holding out possible changes to language, they also said that there would be no change in what the current wording has to say on the sequencing of policy changes (Exhibit 1).

- As a result, we think that the more likely changes in coming months will be to parts 1 and 2 of the current language as outlined in exhibit 1 which in some respects are already looking somewhat obsolete.

- And because of that, RBC's call remains unchanged. We see QE continuing to September as planned with a final 'tapering' then announced to bring monthly purchases to zero based on what the ECB has said about there being no 'sudden stop' to purchases. Three months is the shortest tapering period we can envisage which would take QE to the end of this year. With the current guidance that rate rises would only come 'well' after that point (Exhibit 1) that means that we still see it unlikely that we will get the first rate rise until early in the second half of 2019.

Here is RCB's Exhibit 1: