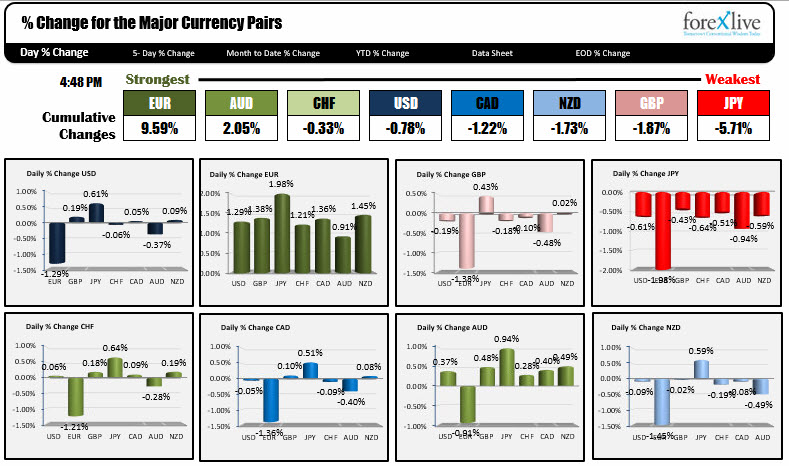

The GBP is the strongest. The NZD is the weakest.

The snapshot of the strongest and weakest currencies shows that the GBP is the strongest while the NZD is the weakest. The USD is mostly higher with good gains vs. the commodity currencies.(CAD, AUD and NZD) and also vs. the JPY.

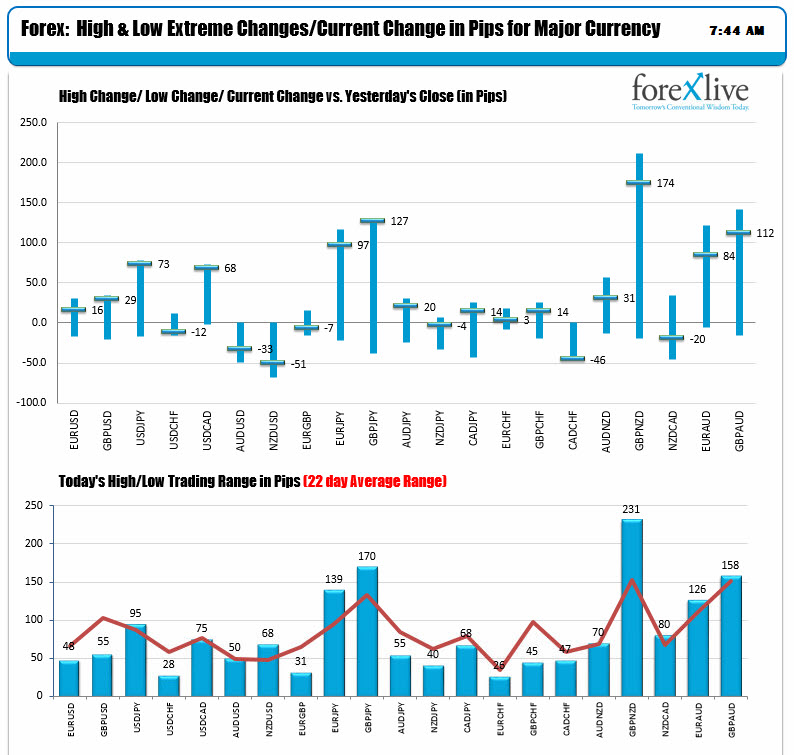

The ranges and changes area show that the USDJPY and JPY crosses (especially EURJPY and GBPJPY are trading near high extremes. The GBPUSD is also trading near its highs for the day - extending what has been a narrow trading range (only 55 pips). The GBPUSD remains within the range from yesterday's trading (high yesterday reached 1.2836 while the high today is at 1.2829 so far).

The European stock markets are modestly higher after yesterday's risk on surge of 2% to nearly 5% in the major stock indices. The German Dax is up 0.08%, France's Cac is up 0.36%, the UK FTSE is up 0.17%, the Italian MIBi is up 0.18%.

In the US the pre-market futrees are higher with Dow futurs up 134 points, the S&P up 4.5 points and the Nasdaq futures up 11.5 points.

US yieilds are higher (that is helping the USDJPY) with the 2 year at 1.2499% +2 BP, 10 year yield at 2.299%, up 2.6 BP and the 30 year at 2.95%, up 2.4 BP

Spot gold is down another -$7.50 to $1268.90

S&P Case Schiller HPI will be released at 9 AM with estimate for a 0.73% gain MoM. The YoY is expected to rise by 5.77%

US New home sales will be released at 10 AM with the estimate at 584K vs 592K last month

Conference board Consumer confidence is expected to fall to 122.5 vs 125.6. Last month the present situation came in at 143.1 and the expectations at 113.8.

The Richmond Fed is expected to fall to 16 from 22.

No Fed speakers as we are in the blackout period before next weeks meeting.

US stocks earnings continue today with Caterpillar, Coca Cola, McDonalds, Chipotle, Lockheed Martin among the big names releasing today).