Imagine trading in an echo chamber

One of the things most striking about global markets is how bad traders are. Not just individuals, even the best of the best.

In other endeavors, like sports, you can watch and easily see what separates them. There are the physical gifts, but there is also the training and mind for the game.

Trading is different. Yes, there are people with mental gifts for numbers and picking winners but beyond that the comparison falls apart.

It crumbles when you look at performance. The average hedge fund returned 5.6% in 2016 compared to 12% for the S&P 500. Two of the top-five paid fund managers badly underperformed the index.

It's like tuning into golf on TV and watching the field miss par.

The general consensus is that running large sums of money is what makes it harder. The big positions make you less nimble and that leads to front-running and squeezes. That's partly true but I have a different theory.

It dawned on me reading a profile on Robert Mercer. He runs Renaissance Technologies, which is the seminal quant fund. He also sounds absolutely nuts.

"Mercer retains a domestic staff that includes a butler and a physician; both accompany him whenever he travels. But this, too, has sparked bad publicity. In 2013, three members of the household staff sued to recover back wages, claiming that Mercer had failed to pay overtime, as promised, and that he had deducted pay as punishment for poor work. One infraction that Mercer cited as a 'demerit' was a failure to replace shampoo bottles that were two-thirds empty."

That's just part of a series of what could be called eccentricities or less-politely called lunacy.

The thing about money is that it elevates everything and attracts leeches that create a bizarre kind of echo chamber. For instance, Mercer fell in love with the ideas of a climate change scientist/skeptic so much that he started funding everything the guy asked for. Naturally, the guy kept coming up with stuff his benefactor wanted to hear.

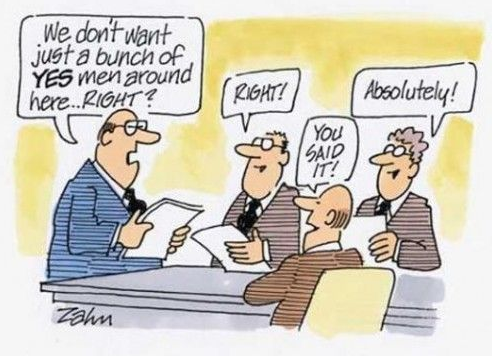

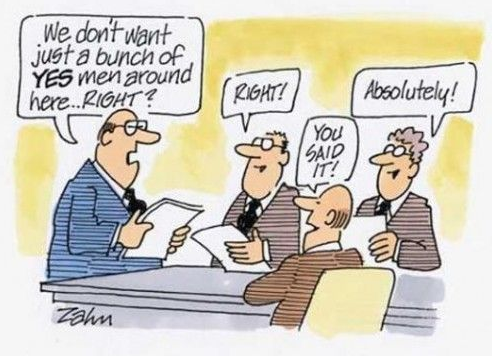

My theory is that the toughest part about continuing to perform as a hedge fund billionaire is that you become surrounded by yes-men. Whatever crazy idea you have, there are 10 people around you (all on your payroll) willing to tell you that it's genius.

That's the kind of thing that would impair your judgement beyond repair.

A great documentary film would be an experiment on yes-men. The premise would be surrounding a regular guy with yes-men and watching him descend into a tyrannical asshole.

That's what it must be like to be a hedge fund titan.