Dollar trading near extremes in some of the major pairs

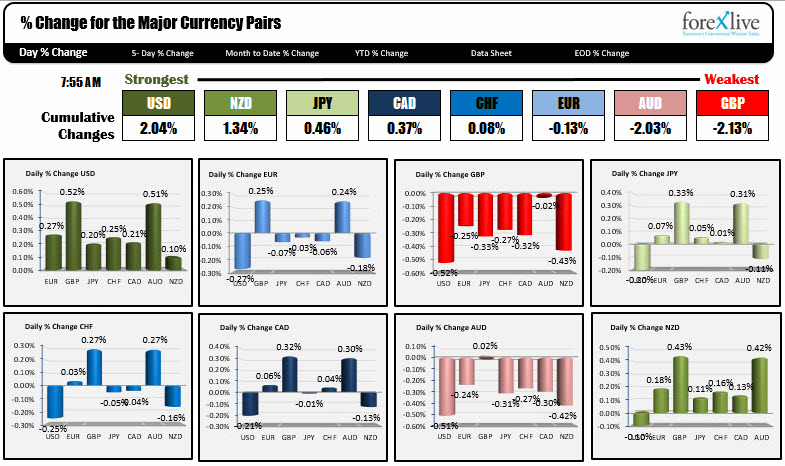

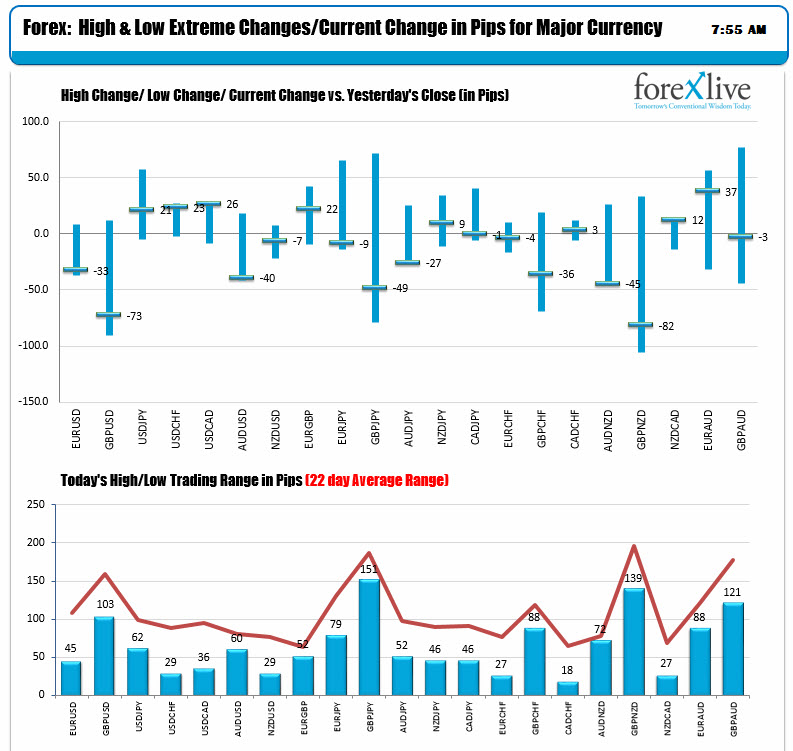

The USD is the strongest and the GBP is the weakest as NA traders enter for the day. UK jobs data was not the best.

In the US today, the FOMC meeting minutes will be released at 2 PM ET. This morning in the US, The Markit flash manufacturing/services data will be released for February with the expectations for 55.5 and 53.7 respectively. That will be released at 9:45 AM ET/1445 GMT. At 10 AM ET, the existing home sales (and revisions) will be released with the expectations of 5.60M vs 5.57M last month. Fed's Kashkari will speak at 10 AM ET. At 1 PM the US will auction 5 year notes too, followed by the FOMC meeting minutes at 2 PM

The most activity is in the GBP pairs today (with the data release being a catalyst), but the volatility as measured against the 22-day average trading range, is limited in most currency pairs. That may be a precursor for more movement. Be aware.

In other markets, the snapshot is showing:

- Spot gold down $1.14 or -0.09% at $1328. Yesterday the price of gold tumbled more than 1% on dollar strength and some technical selling.

- WTI crude oil in trading down -$.38 or -0.63% at $61.40

In the US debt market, 2-year yields are higher but the rest of the curves is flat:

- 2 year 2.2580%, +3.9 basis points

- 5 year 2.641%, -0.3 basis points

- 10 year 2.880%, -0.9 basis points

- 30 year 3.148%, -0.3 basis points

US stocks are also mixed

- S&P futures on applying a decline of -2.86

- Dow futures are implying decline of -36 points

- Nasdaq futures are implying a rise of 17.5 points

In Europe:

- German DAX, -0.65%

- France's CAC, -0.38%

- UK's FTSE, unchanged

- Spain Ibex, -0.90%

- Italy's FTSE MIB, -0.56%