The DOE inventory data comes in line with expectations

The DOE inventory data came in as expected. So there has been a limited impact on the price of crude oil and the USDCAD. Nevertheless, the USDCAD just traded to a new session low at 1.2555. The earlier low for the day was in the first hour of trading at 1.2559. The high extended to 1.2598. The price is bouncing after failing on the new low. We currently trade at 1.2567.

The price action has been up and down for the day. In the Asian session, the pair move higher on the back of comments from Trump that he was not confident about coming to an agreement on NAFTA. Of course he was in front of an audience and that tends to influence his content. There are comments from Canada as I type saying that the Canada priority remains the same and they do anticipate "heated rhetoric" in the trade talks.

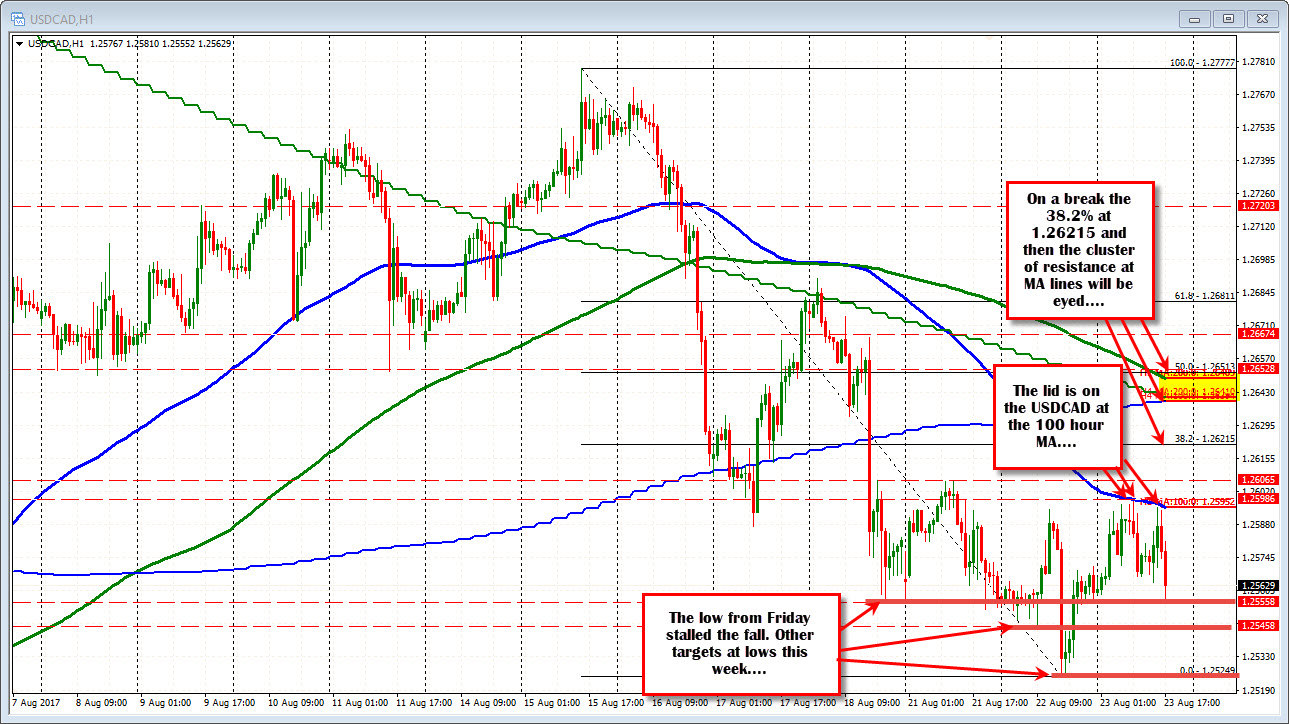

Technically, the rally in the Asian session, ran into the 100 hour MA (blue line in the chart above) currently at 1.2595. That MA was tested a number of times. The high in the North American session got within a pip or two, before rotating back to the downside. That lid on the pair makes that level a key level going forward. A break should solicit more buying, with 1.26215 (the 38.2% retracement level) the next upside target. Above that and the cluster of MA lines come in the 1.2540-51 area. But so far, the sellers have been more in control by keeping that lid solid.

On the downside, the lows for the week (and from last Friday) at 1.2556, 1.2545 and 1.25429 are close targets. The range for the day is only 43 pips, so there is room for an extension of the days range in either direction. The 22 day average is at 91 pips.