US dollar traders thought Yellen had removed 'patient', she hadn't

Once again, witness the power of the Bloomberg red headline.

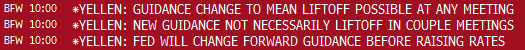

Trading decisions are made in a moment and here is what the market saw.

Yellen: Guidance change to mean liftoff possible at any meeting

If you're reading that quickly, it sounds like she's saying that a change in guidance is coming and that liftoff is possible as soon as April.

But the headline was part of a package that needed to be read together. Combined the headlines say that 'new guidance' isn't necessarily coming but when it does, it would mean that a hike is possible at any meeting afterwards.

In the full text of her testimony she doesn't tip the nod either way, it's basically a recap of what we know already and emphasizes that when 'patient' is removed (no hint at when), it won't necessarily foreshadow a hike.

The FOMC's assessment that it can be patient in beginning to normalize policy means that the Committee considers it unlikely that economic conditions will warrant an increase in the target range for the federal funds rate for at least the next couple of FOMC meetings. If economic conditions continue to improve, as the Committee anticipates, the Committee will at some point begin considering an increase in the target range for the federal funds rate on a meeting-by-meeting basis. Before then, the Committee will change its forward guidance. However, it is important to emphasize that a modification of the forward guidance should not be read as indicating that the Committee will necessarily increase the target range in a couple of meetings

All and all, the whipsaw in the US dollar on the headline is a failure of communication. It's partly on the Fed's but mostly on Bloomberg and the traders who read the headlines too quickly.

Now we head to the Q&A portion and that's when Yellen might hint that patient will be removed at the upcoming meeting -- then the US dollar will rally again.

For more on Yellen's prepared remarks and the full text of her opening statement, see here.