US ISM manufacturing PMI preview

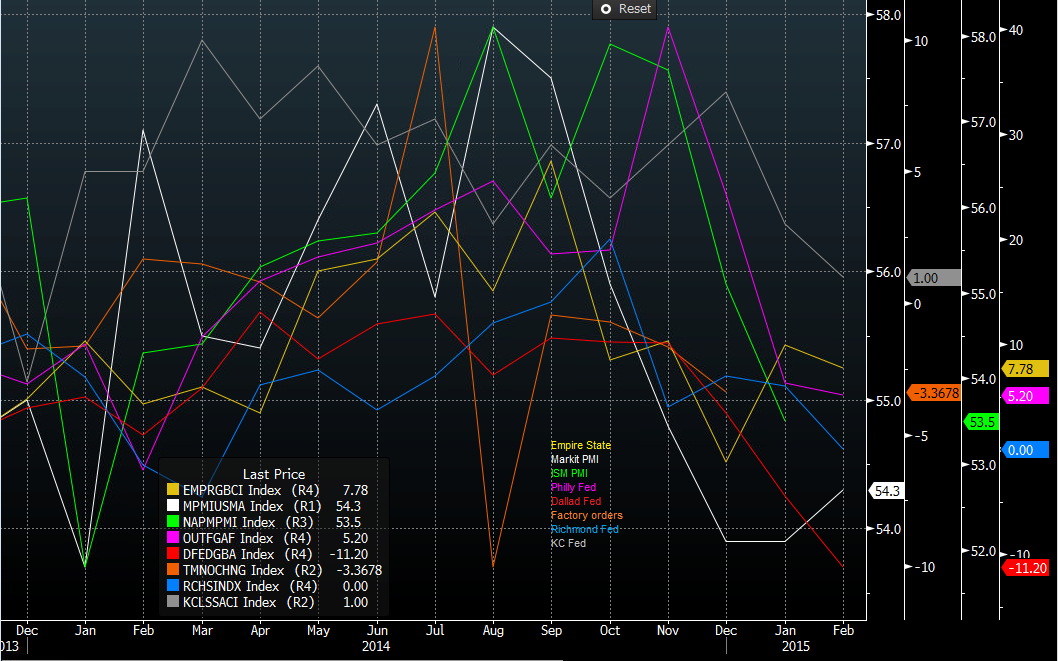

This month hasn't been too hot for US manufacturing, as it hasn't been for a few months now.

While most of the big numbers still point to expansion, we've been seeing them slide.

I'll continue to use the UK as an example as there are similarities between what we have seen here and are now seeing in the US. We saw high levels of gains in the early part of 2014 which tailed off in the second half of the year. The US could well be seeing the same thing. It's obviously a much bigger monster than Old Blighty so any signs of coming off the boil could take longer to pan out but could also last longer too. The employment numbers have been flattening too which suggests that we start to see the labour market finding a plateau.

If the US wants to see a strong manufacturing performance this year then we need to get back to winning ways and this is the perfect time to gauge the early year optimism in the economy. If we see better than the 53.0 expected (and 53.5 prior) in the ISM then that will take some pressure off. If we see another drop then that's going to mark four months of negative numbers and that points to a trend. If it continues into five and six months then that's going to hit growth and the Fed might have to sit up and take notice.

The Markit final PMI number is due out 15 minutes prior to the ISM at 14.45gmt and is expected in unchanged at 54.3 it's been the only number to bounce this month.