All the tidbits I’ve picked up so far have been good-sized sellers of EUR/USD. Big US money-center bank, China and a few others were sellers near 1.4000 but that was not enough to keep EUR/USD from surging as high as 1.4050 where decent offers are rumored.

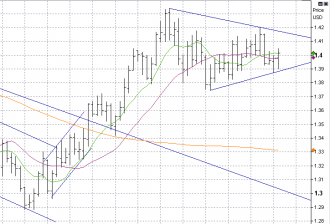

The economic calendar is empty and prices have a pretty open playing field today. Having tested recent range lows yesterday there is no reason we don’t move back up toward 1.42 in the days ahead. Or move back to 1.3880. It is pretty much a question of who is caught out and how high their pain threshold is at the moment.

One flow making the rounds this morning was a US investment bank bought a 1.2900 EUR/USD put for expiry in early September. They’ve been big dollar sellers in recent weeks, so maybe that’s a stoploss…