Which is the aberration? The slide on the RBA’s failure to act or the rally as the globe prices in aggressive quantitative ease from the Fed, the BOJ, maybe the BOE and who knows who else may toss their hat in the ring before long.

The term “currency war” is being bandied about from Sao Paolo to Tel Aviv and the dollar is winning hands down in the race to the bottom.

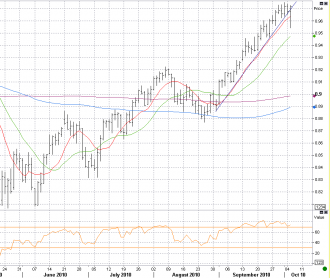

Against a backdrop of record gold prices and surging industrial and agricultural commodities and a swooning greenback, the Aussie has recouped all of its RBA-led losses and then some and trades back above its broken trendline on the daily chart at 0.9695.

I’m at a loss to tell you how to trade it from here. Some are clearly relieved to sell AUD/USD anywhere near 0.9700 after the near-death experience of having sat through a slide to 0.9543 following the RBA meeting. We trade now at 0.9716, a mere 30 pips from trend highs. Too late to climb back on board the long side, in the near-term but not too late to take profits if 0.9750 holds.