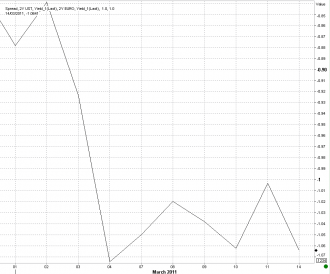

Now that the euro pact is out of the way for another 10 days (until it is ratified March 24-25), the market has turned its focus on to yields. The spread between 2-year German and US paper has widened 6.5 bp in favor of the euro again.

Though the pact proved more bark than bite, the CDS market had widened so much ahead of the summit on Friday that spreads have narrowed-in considerably today.

Can’t keep a good euro down… Central banks remain in buy-dips mode while sellers are seen toward 1.3980/90.