Looks like we are doing risk-on, risk-off again.

The JPY trades weakly versus the Euro, the commodity currencies and even GBP while equities rally and bond yields rise.

More and more Wall Street analysts have called a low-yield, high price for the year in US Treasuries, a major risk-on bit of info. JP Morgan was the latest.

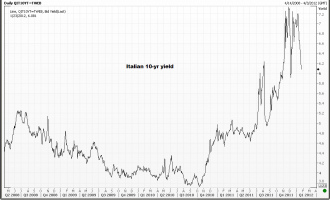

The key for me, as far as risk is concerned, is the slide in European sovereign debt yields. Clearly the market has come to the notion that the ECB’s LTRO program will tide-over the banks in the near-term, which means sovereign governments won’t likely have to come to their rescue, straining already bloated budgets.

1.3080 remain pivotal resistance in EUR/USD with a bulging book of stop-loss buy orders above 1.3100.