The German bund market is the tell.

Yields are at record lows across the curve today with 2s at 0.05%, 10s down 7 basis points to 1.399% and 30s below 2% for the first time.

The conventional thinking is that AAA-rated German debt is the safest haven but that’s not the lone, or even the main driver at the moment.

Fears of a eurozone breakup have made depositors, especially large accounts, worried about forced conversion. In other words, people and businesses in Greece in the periphery are worried that their governments will confiscate euro deposits and exchange them for some new type of currency.

If the euro breaks up, the best way to guarantee your government doesn’t take your money is to put it in an instrument controlled by a foreign government . Even though you get no yield, you hold a giant call option on a new German currency.

As these fears are magnified, don’t be surprised if the schatz falls below 0%.

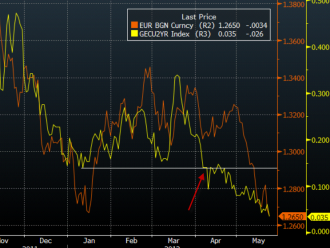

Notice how the break of support in schatz yields below 0.15% preceded the euro breakdown. A fall below 0% will foreshadow another euro tumble.