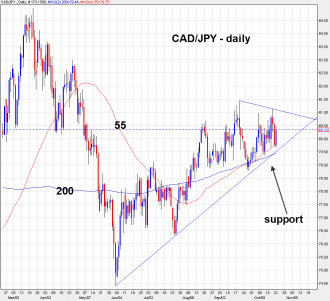

CAD/JPY has been around 80 since July but may soon breakout.

M&A and central banks are the drivers in both.

Tomorrow, the BOC could remove its hawkish bias while next Tuesday, the BOJ by toss another 10T yen into the QE pit.

CAD is suffering because the government rejected inbound M&A while JPY is lower because government-promoted outbound M&A is finally starting to occur.

Today, CAD/JPY has made solid gains and that tells me that the more convincing story is JPY weakness (ie CAD/JPY strength). The risk is a squeeze in CAD trades because the market is too long.

USD/CAD broke through some important levels today and CAD/JPY could do the same if the cluster of support around the uptrend since June and the 55-day moving average break.