The FT bravely takes on the narrative of the wild swings in market sentiment before/after the election. The verdict: no one knows anything.

Yesterday we saw a few commentators note that the market was rallying because of the increasing certainty that Obama would be re-elected and the leadership of the two branches of Congress would remain the same. Today, with that certainty firmly established, the markets have wiped out all of yesterday’s gains — and the argument is the precise opposite: the certainty that Barack Obama is president and the House remains Republican mean further gridlock.

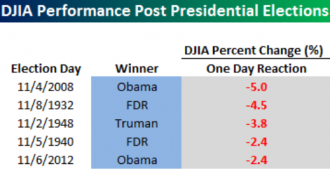

Bespoke shows that large declines in stocks are common the day after a Democrat is elected President.