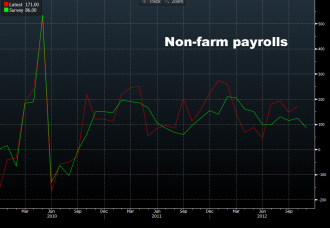

Here are some of the numbers to consider ahead of tomorrow’s non-farm payrolls report. Release time is 8:30 am ET.

- Median estimate 86K (90K private)

- Oct reading: 171K

- High est 145K (Nomura)

- Low est 15K (Morgan Stanley)

- Standard deviation: 32K

- NFP 6-month avg 137.3K

- Unemployment rate est. at 7.9% vs 7.9% prior

- ADP 118K vs 157K prior (125K exp)

- ISM manufacturing employment 48.4 vs 52.1 prior (low since 2009)

- ISM non-manufacturing employment: 50.3 vs 54.9 prior (low since July)

- Challenger job cuts 57K vs 48K in Oct, siz month high

- TrimTabs estimate based withheld income and employment taxes 202K

- Consumer Confidence jobs-hard-to-get: 38.8 vs 38.8 prior

- Philly Fed employment: -6.8 vs -10.7 prior

- Chicago PMI employment: 55.2 vs 50.3 prior

- Initial jobless claims 4-wk moving avg: 367K vs 367K at the time of the Oct jobs report

- Conference Board’s Help Wanted OnLine (HWOL) Index: -15.7K to 4720K

- Sept JOLTS job openings: 3561K vs 3653K exp

Aside from the Hurricane Sandy skew, you also have to factor in seasonal holiday employment (which seems to be higher than last year) and the 15K layoffs due to the Hostess bankruptcy.

Overall, there is the potential for a big miss (70K or more). My favorite pre-NFP indicator is the employment component of the ISM non-manufacturing index and that was barely in positive territory.

My feeling is that there is money on the sidelines that is waiting to buy risk assets but is wary of the headline risk. There will be a kneejerk lower but it might not last. So long as employment is at least 25K and the unemployment rate doesn’t rise above 8.1% my best trade would be to buy the dips. As usual, the timing is everything.

Employment has been consistently better than expected in recent months but the economists tend to adjust in the longer term.