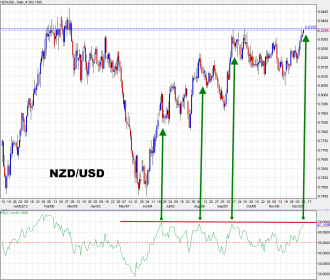

NZD/USD is just a few pips shy of reaching the highest level since March as it gains for a sixth straight day.

The kiwi was the best performer last week after the RBNZ signaled it was likely to hold rates at 2.50% for the foreseeable future.

It’s rare for a currency to gain for six consecutive sessions and longs would be wise to take profits here. Shorts may consider betting on a retracement.

At this point, I expect 0.8356 to break and run through some stops. That should present some attractive levels for a one or two-day short.