It’s tough to put a price tag on political shrewdness but Portugal and Ireland may be playing a masterstroke as they opportunistically seek to renegotiate bailouts.

Eurozone finance ministers will meet tomorrow to discuss altering repayment terms for Portugal and Ireland. One option is to delay payments 2.5-5 years and Ireland is asking for 15 years.

The official spin is that the current terms would force them both to refinance at the same time. That’s a lark — as if two tiny economies issuing debt at the same time would put a strain on the financial system.

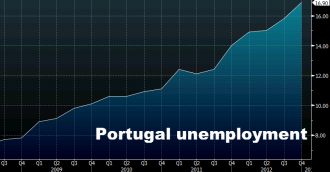

The truth is that austerity is failing and leaders are scared about political turmoil. The EU forecast a -1.00% contraction this year but economists see -2.15%, with risks on the downside.

The Italian election has been a stroke of luck for Portugal and Ireland. It reminded leaders around the eurozone that the main risks are political. They saw the 80 basis point jump in Italian 10-year borrowing costs and don’t want to see it spread after repeatedly claiming that the crisis is over.

Portugal’s opposition socialists are ahead in the polls and calling for a renegotiation of debt terms. By giving them what they want, eurozone leaders diffuse the risks and give current leadership a boost.

A decision won’t be made at tomorrow’s meeting but the austerity agenda of Merkel & Co. is no longer holding the upper hand.