ForexLive’s Louise Cooper sits down with the BRICmaker and puts the most-important global trend in perspective.

He may only have five weeks left as Chairman of Goldman Sachs Asset Management but Jim O’Neill is not changing his tune. We were both speaking at a conference Friday – he got the glamour of the BRIC 4 and I got the depressing Euro 17. But in Jim’s opinion, ignore the headlines – forget the Fiscal Cliff and the Eurozone crisis is extraneous, it’s all about the developing world. To put it into context economically, China creates another Cyprus every week. It’s still all about the acronym that made him globally famous and not just in finance.

In 2013, O’Neill’s firm is forecasting Brazil to grow at 4.0%, China at 7.9%, India at 7% and Russia at 4%. So in total the four BRICs are to power along at 6.9% and what he describes as “growth markets” at 6.4%. Compare this to the 1.5% forecast in advanced economies. In total, thanks to the fast-growing world, global GDP is to expand 3.7% in 2013 and 4.1% in 2014. For any global investor, there is no crisis – there is plenty of growth. It’s just not in the old world.

He also points out that BRICs are becoming large economies in their own right. Chinese GDP is $7.3tn whereas Italy is $2.2tn, Spain $1.5tn and Greece an immaterial $300bn. BRICs together create an Italy every year, which is still the eighth largest economy in the world. And China by itself almost creates a Spain a year.

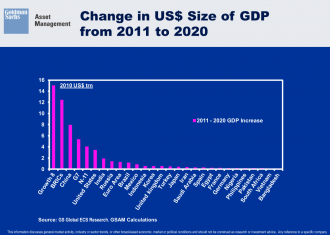

Looking into the future, from 2011 to 2012, GSAM expect the US economy to expand by almost $4tn, but China by itself is to expand almost $8tn and the BRICs over $12tn. The Euro area? Almost irrelevant at less than $2tn of additional output over the decade. And these forecasts include a significant slowdown in BRIC countries from 8.1% expansion in 2000s to 6.6% in 2010s.

The G7 will still make up the largest combined economies in 2020 at 43% of global output, but the “Growth 8” are not far behind at 34%. The speed of catch up is extraordinary.

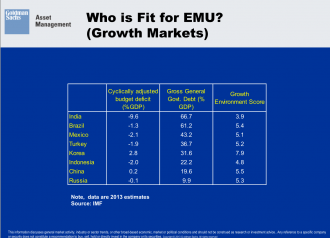

In a rather cheeky slide, Jim points out that his “Growth 8” mostly make the fiscal conditions for EMU entry. With the exception of India, all run budget deficits below 3% of GDP (and two run budget surpluses – when was the last time that happened in the UK?)

The total government debt to GDP ratios are all below 60% of GDP with the exception of India and Brazil at just over 60%. But compare these figures to the UK which is still forecast to have a debt to GDP ratio of 85.6% of 2016/17 and the EMU average is 94.9% in 2013. Current members of the EMU are less fit for euro membership than the developing countries. I think Jim finds that rather entertaining.

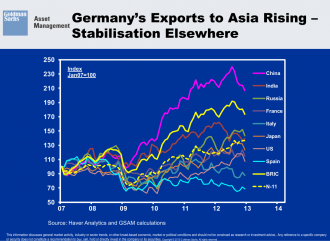

The BRICs story intact, a US economy rebounding with a recovering housing market – there is growth – struggling economies just need to find a way to tap into it. Jim points out that if Germany carries on the way it is, it will be exporting twice as much to China in 2020 as to France. His chirpy Mancunian cheekiness then came out as he suggested Germany would be better off in monetary union with China by then! He adds that if the EZ crisis is not solved soon, then the growth of trade with China and other BRICs would make the euro pointless anyway. In this he thinks the UK government’s stance to re-evaluate the relationship with Europe – promising a referendum – is justified economically. If the UK, or any other country, wants to guarantee their future prosperity, they need to find something to sell to these fast growing countries.

As you would expect from such a top down BRIC positive view, GSAM is heavily overweight emerging markets – slide from 47.

Jim delighted in telling us that David Cameron stole his line: “China is moving so fast it’s creating a new economy the size of Greece every three months“. And since that first quote at the Tory party conference last September, Mr Cameron has continued with the same theme in other speeches.

Michael Palin’s whole TV series and book on Brazil was inspired by Jim O’Neils’s belief in the BRICs. To quote Mr Palin from a Guardian newspaper interview

“In 2001 Jim O’Neill, coined the acronym BRIC for what he saw as the global super players of the future. Russia, India and China we might have expected to be included, but Brazil, the “B”, really caught the eye. Less than 10 years previously, Brazil was suffering 2,700% inflation. Now we were being told by a highly respected economist that the sun was shining out of its backside. Suddenly the exotic paradise sounded a lot more like the rest of the world.”

So what does Jim do now? Become a hedgie? Despite many offers, he promises me he won’t (its not like he needs the money). Do a Tony Blair and jet around the world on speaking engagements? I’m sure he’s getting the offers but I can’t see it. Do a Gavyn Davies (another ex Goldman partner and high profile economist) and become chairman of the BBC? I don’t think he wants to run the BBC but he is a great broadcaster, so maybe a future on the airwaves beckons.

Quoted by the British Prime Minister, friends with one of the Monty Python gang, and his clients are some of the most powerful financiers in the world. He may not have met Putin, but he is a power player. Thus I imagine Jim’s leaving party will show little signs of banking austerity. After eighteen years at Goldman, he is going to get a good send off. An invite to Jim O’Neills’ leaving do will be the hot ticket in London this Spring.

Thus my choice in song this week: