A credit crunch may be underway in China as the PBOC turns its back on the money market.

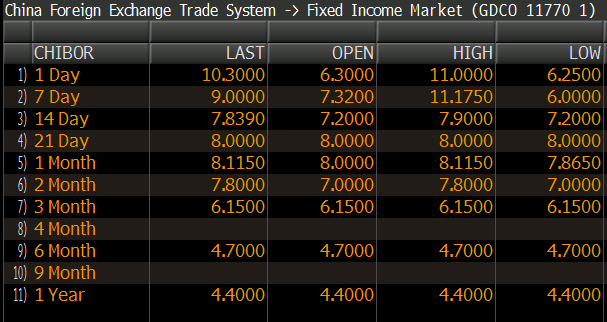

One-day repo rates rose to a more than 5-year high today at today at 11.0% from 6.3% at the open in the Chinese interbank market (CHIBOR). Interbank repo rates hit 15% for overnight lending a 12% for two weeks (up more than 400 bps).

CHIBOR

Periodic bouts of liquidity in the Chinese lending market are rare but not unprecedented. Similar episodes have hit in the past 3 years but this time may be different.

The state-run China Securities Journal ran a front-page story saying authorities must control the pace of money supply growth. Yesterday, the PBOC even drained 2 billion yuan from the money market.

Fears about rising rates last week were explained away because of a three-day holiday to start the week but rates haven’t normalized.

Wang Tao, an economist with UBS, is highlighting the problem.

“A liquidity crunch could happen unexpectedly somewhere,” she said. “There could be a disorderly deleveraging in the interbank market.”