This is a post about finding the right state of mind for trading. Most specifically, what is the fine line between confidence and over-confidence?

Any trader dreams about a day where he can sit down in front of a terminal and hammer out trades with supreme confidence — doubling down on losses until they turn to gains, never doubting. That’s a fairy tale. Try it and be humbled.

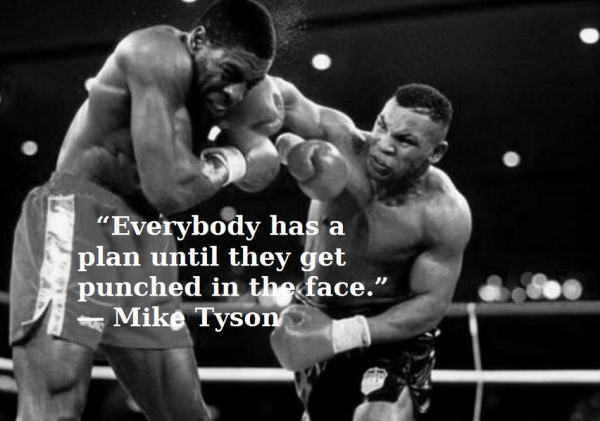

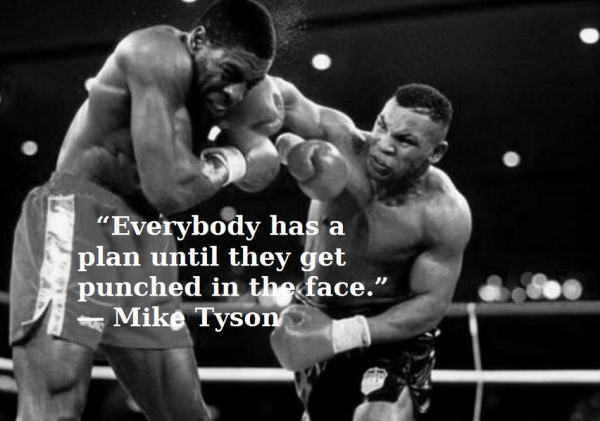

The best traders in the world ooze confidence yet they constantly second-guess themselves. The first page of any book on trading tells you to make a plan. That reminds me of this sage wisdom from an unlikely place.

The other problem with plans is that new information is always entering the market, especially in FX. As the story changes, you have to change. At the same time, it’s easy to lose perspective and you can’t freak out over every little piece of news.

Some sort of perpetual calmness or serenity might be an idyllic state for trading but it’s unrealistic. Even a monk spending hours a day meditating doesn’t have that kind zen. Instead, we try to understand our emotions and guard against the worst ones. I posted a video of Paul Tudor Jones a few months ago and he was the farthest thing from serene but he managed his emotions and separated his decision making from how he felt.

Ultimately, I think one of the best qualities is the ability to forget. To clear out all the baggage and re-evaluate. It means periodically asking: Why did I get in this trade? Has something materially changed? Am I missing something?

That last one is the tough one (and we’re here to help) but if you can step outside the emotions, keep things in perspective and manage risk, there’s money to be made. Thanks for taking the journey with us.

Before you make a single trade, here is the most important characteristic you need to build in yourself.