Our third Guest Trader slot has been kindly filled by reader Alex and this week he will bring you some wise words of wisdom and give yet another view of how we traders try to navigate around this crazy business we’re in. You may remember him from a previous post where he had been using a secondary currency index to the DXY.

Is it time to put DXY in the bin as a trading indicator?

Hailing from Italy I’m sure you’ll give him a warm welcome.

Name: Alex

Occupation: F/T trader

Trading experience: 2 years full time, 1 year on/off stocks on Italian FTSE-MIB

Why you started trading? First, my full time job made me so de-motivated that I needed something new to exploit my skills and my full degree in Economics, second the money.

Time zone you trade in London + NY, sometimes Asia.

Trading platforms/chart systems/screen set up you use: MetaTrader 4; as hardware I use a lot of second – hand crap… I assembled my PCs and I know how to make them work; I know some basic programming in MQL language enough to modify MT4 EAs to suit my trading;

Methodology (Scalper, short, med, long term) Day-trader, Short to Mid – term, trend follower + breakout trader;

Trades you are in or looking at: EUR/USD, GBP/USD, USD/JPY, EUR/JPY, Commodity currencies, Mini S&P500. Sometimes I trade Nikkei, Gold and Crude Oil.

Hi everybody, my name is Alex and I’d like to show you how I trade. I’m not so presumptuous to teach anything to anybody, because I consider myself a novice to Forex trading and I‘m still learning everyday. I’m like a greenhorn, less green but not yellow yet, let alone orange or red. I like to think that the market teaches us new lessons everyday, and we have to assimilate them in order to improve our skills so to survive this minefield. I also think that learning from our experience (good or bad, especially bad) is critical to become successful in a job like this. I stopped a mild successful trading in stocks because Financial Transaction Tax was likely to be introduced in my country (I was right) and I had to find something alternative, as soon as possible, so I chose Forex. It’s a lot more difficult than stocks, though…

Day 1: Short – term trading, money management, Di Napoli, my setup;

When I’m trading short term or just scalping I firmly believe in price action, pivot points, and offer/bid price levels as you can get in the ForexLive orderboard, plus some gut feeling. I don’t use oscillators, indicators, other techs so my setup is very simple. First at all I like to recognize the main direction of a trend, if exists, or if I’m in a range or in the retracement of a big move, because I don’t like to trade against the main trend.

To do so I use 4H charts and Ichimoku plus a bunch of simple moving averages and MACD oscillator and I’ll explain that tomorrow. Why these premises? Because you have to distinguish the forest from the trees. But a short term / scalping setup is a standalone thing good to trade whatever you want, even against the trend, maybe to catch a move because you may want to cover another move, or maybe just for the sake of it, because you know that you’ll close it as soon as possible after reaching your target.

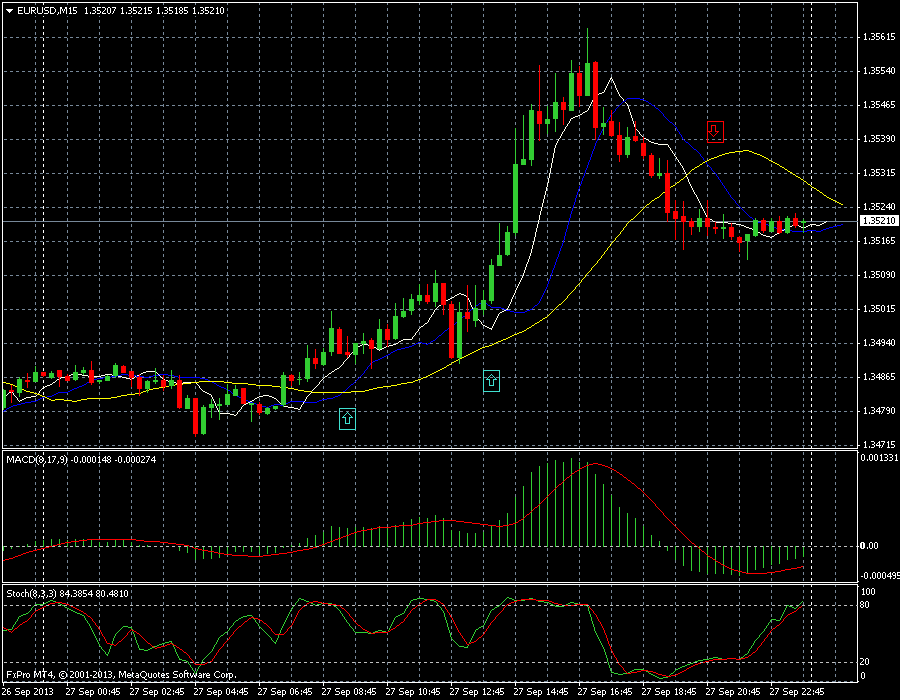

So I chose 15 minutes charts against the maybe more popular 5 minutes, because I believed that the former timeframe offers more stable price action. As a template I started from a popular setup called Di Napoli and MT4 presents it as a standalone template. It’s rather simple, it consists of standard Heiken Ashi candles, three shifted moving averages (SMA3 shifted 3 periods ahead, SMA7 shifted 5 and SMA25 shifted 5), plus MACD (8,17,9) and Stochastic (8,3,3). Forget the SMA7 and the two oscillators and go long if: SMA3 crosses SMA25 from down to up, the candle is green (bullish) and long body, and its base is above the SMA25, stay long ‘till needed or if price goes against you, as candles become red and mixed, the SMA3 crosses from up to down the SMA25, etc…). To go short follow the opposite rules.

EUR/USD M15 chart Di Napoli setup

The use of this basic setup must be weighted with all the information you know about the market in that moment to avoid false signals (proximity to news or data due in a short time, session close due in a short time – beware of London fix!, some conference by central bankers or by other financial big guns, etc.).

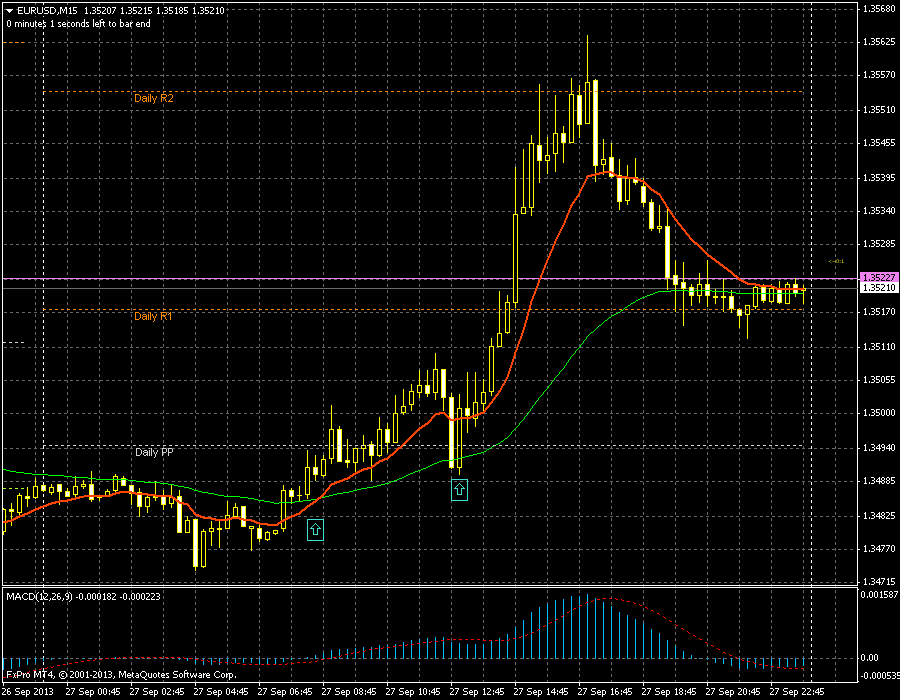

Oscillators can reassure you during the trade but don’t count too much on them, they are almost useless below 4H time frames. This setup can work on any timeframe, better on longer ones. My current setup is a slight variation of that one: I use standard Japanese candles, EMA12 not shifted instead of 3SMA shifted 3, EMA48 not shifted instead of 25SMA shifted 5, same MACD, same rules for entry. This derives from a very good trend – following system I used once on 1H+ timeframes. Notice how the candle closes, while in a bullish trend, try to respect the 12EMA and wicks do not cross the 48EMA. Notice also that when you are in a range, and I usually don’t trade it, the moving averages make a sort of a fan and candle closes are randomly above / below the moving averages.

EUR/USD M15 My set up

I mentioned Daily pivot points: to calculate the medium price of the previous day I use a variant of the standard method of calculation and so we have (High +Low+ Close +Open of the present day) / 4. They are also useful for sentiment evaluation, if the price action is above / below the current central pivot, and should be used together with the price levels of the ForexLive orderboard / option expiries.

This setup works best with high volatile pairs as in example jpy crosses or in high volatile times (not current times, alas!), better practice it by doing paper or demo trading before trading lots as they were Monopoly money!

You can catch all our previous Guest trader analysis here.