Just looking into these Swiss moves to see if there’s anything behind them and it appears there is.

On Sunday there is a Swiss referendum on whether the monthly wage of the best paid workers working at companies in Switzerland should be no higher than the annual pay of the worst paid. If it passes, the “1:12″ initiative may see the Swissy get hit but if it fails then we could see the Swiss pairs fall fairly hard. This is the second time a referendum has come up this year as earlier a vote went in favour of curbing bonuses. Some background on the story from Bloomers here.

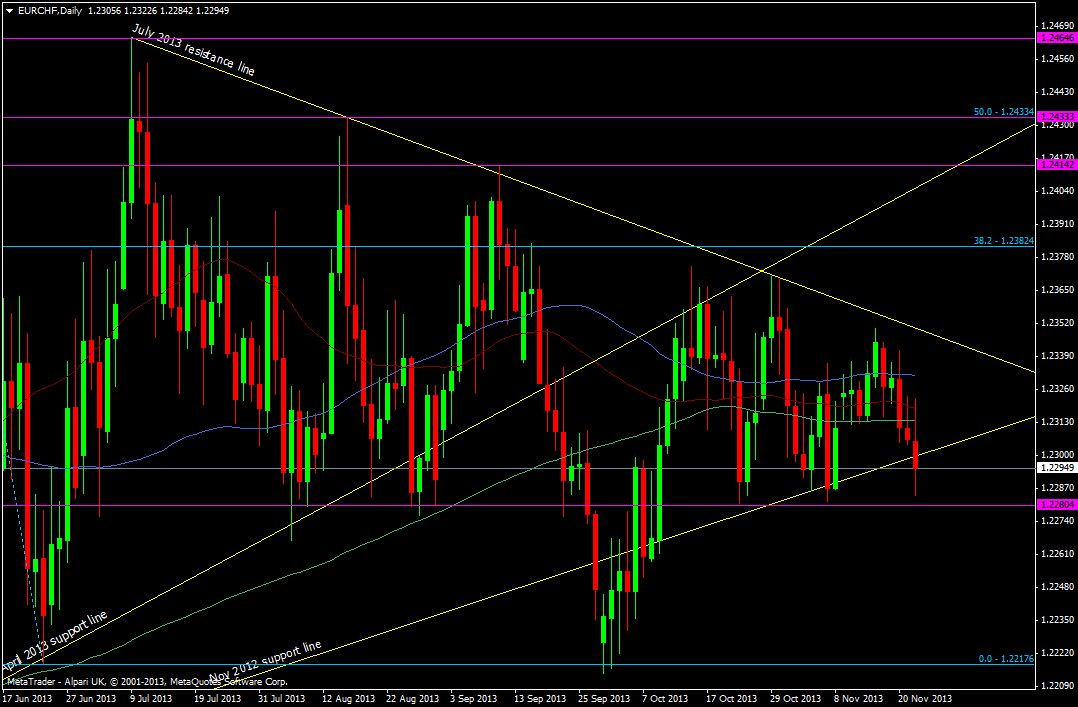

Today’s move is an ominous sign as we’ve broken below the Nov 2012 support line and a close below could spell trouble.

EUR/CHF daily chart 22 11 2013

The 1.2280 level is one to watch as it has been a historical support point. Below there the low 1.22’s and 1.2218 are the next levels to watch.

With the ECB worried about falling inflation and the rising risk of negative deposit rates things could start to get ugly for the SNB. They have previously touted negative rates themselves so they may start jawboning about it once again in an effort to protect their currency. With deflation worries in Switzerland looking like they’re not materialising and a slow improvement in the economy, they may start facing inflation and the prospect of having to start looking at rate rises. How they’re going to do that without putting stress on the currency is beyond me. That’s one to worry about next year though.

Any which way you look at it I’ll be lapping up any falls towards the peg and by the time the referendum happens I’ll be snoring off a hangover courtesy of my soppy football team and a Queens of the stone age gig.