The Iranian oil minister, Bijan Zanganeh has wasted no time on the back of the nuclear talks and possible lifting of sanctions. He’s dusted down his best suit and has been out courting investors for Iran’s energy industry.

As usual big oil companies were lining up to pillage invest in the early 2000’s but the troubles saw them back away. Zanganeh has already met with European companies and with US companies indirectly says the FT via Reuters. The queue to get back into Iran is already forming but with major sanctions still in place it could be a while yet.

On the face of it it’s all good news coming out and news that could bring some stability to what has been ongoing hostilities. The yanks are still not easing off on the overall picture but the nuclear talks are just a start.

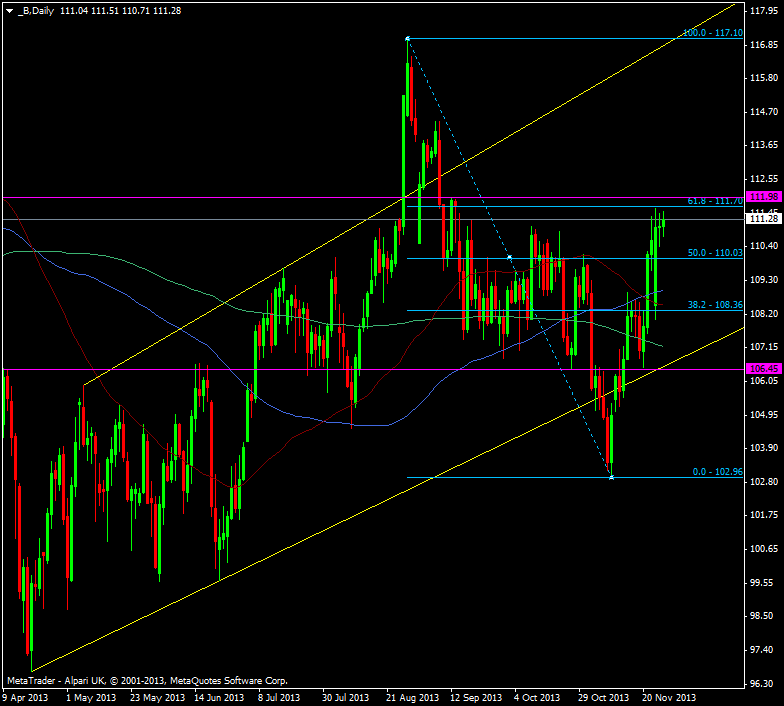

The deals so far haven’t brought about an increase in oil exports out of Iran just yet and so Brent crude is trading on that happening any time soon. The initial weekend breakthrough saw oil open around 250 ticks lower at about $108.50 on Sunday night and it’s been back up to the $110-111 level since.

Brent daily chart 27 11 2013

We have the 61.8 fib from the August hi/lo at $111.70 and this has capped things for the last few days. Just above there is the 12/13 Sep highs at $111.98. In part, crude has been following a channel since April and we’re more or less bang in the middle. The rise since October could come to have some bearing on inflation figures which have seen large falls in energy inflation. I’m liking a short trade up here and am short from $110 and $111. I’d be looking at adding at $112 also with a stop through $115.