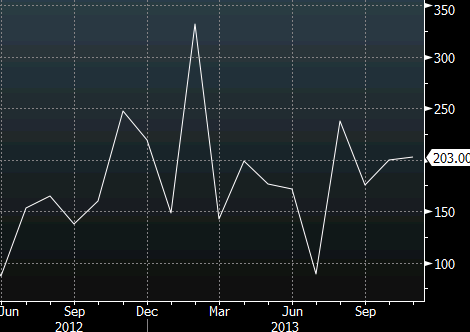

If the Fed doesn’t taper in December it won’t be due to a weak jobs market. Over the last four months, the average job gain is 204K and that indicates a sustained level of solid job creation.

Non farm payrolls

The best part of the report is falling unemployment on a rising participation rate. Had the participation rate simply held steady at 62.8%, unemployment would have fallen to 6.8%.

PIMCO’s Bill Gross is on Bloomberg radio saying the odds of a taper on December 18 are now 50/50 and other economists are saying the same.

For me, the jobs situation is strong enough to taper, or at least strong enough to signal a January taper. The reason not to taper is inflation. PCE inflation (which is the Fed’s preferred measure) fell to 0.7% y/y from 0.9% and core PCE slipped to 1.1% from 1.2% y/y.