The theme for 2014 is consensus. There is an overwhelming consensus of analysts looking for the same things in the year ahead. We look at four crowded trades and cast a verdict on whether the groupthink will be proven right or wrong.

#3: The Canadian dollar will decline

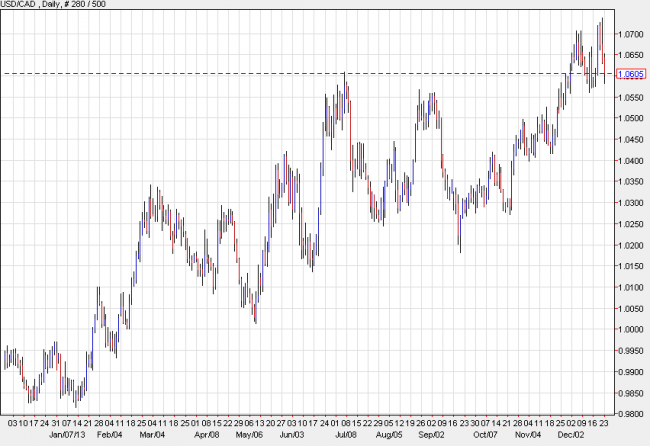

The Canadian dollar had its moment in the sun. For years it was the darling of the currency market as Canadian banks sailed through the crisis and the economy sped along. In 2013, Carney left and the loonie lost its mojo, stumbling to a three-year low. Now analysts are piling on, with many saying it will fall another 5% to 1.1400.

The oldest, surest way to trade currencies is to follow central banks. As Australia’s central bank cut rates in 2013, the Australian dollar struggled. It finally found a bottom when policymakers signaled that cuts were no longer coming.

For the most part, analysts missed the trade in AUD but they feel like they have a second chance with the Canadian dollar. Shortly after the RBA went to the sidelines, the Bank of Canada shifted from a hawkish stance on interest rates to neutral. That change woke the hibernating CAD bears and the currency weakened more than 4%.

The BOC’s main worry is deflation, prices rose just 0.7% year-over-year in October and business investment hasn’t picked up the way Poloz expected when he got the job.

Now, David Rosenberg and Goldman Sachs are two of many marketwatchers who are saying to sell the loonie.

Here’s why they’re wrong. For one, deflation isn’t a Canada-only story. November Canadian CPI picked up to 0.9%, which is the exact same pace in today’s US PCE report. Second, it’s tough to be bullish on the United States but bearish on Canada. If US companies begin to invest or the US economy grows, it won’t take long to spill across the border.

The Bank of Canada story is overplayed. With the loonie already weakening, that will put upward pressure on prices and there is no realistic scenario where the BOC cuts as the US economy accelerates. The consensus is for no BOC rate hikes until at least late 2015. If the US economy accelerates this year, those hikes will come sooner.

We could see USD/CAD continue to rise in early 2014 but selling close to 1.10 will prove to be a much better trade than betting on 1.14.

USD/CAD rose throughout 2013