Standard Chartered see the aussie dollar getting some support from Japanese investors who have been net buyers of foreign for the last 10/11 weeks. Seeing as Australia has been a preferred choice for investors they are assuming that further flows could be likely and this would add support to the buck in the short term.

The cite the latest investment data from Japan’s ministry of finanace, which shows that inflows to Aussie sovereign bonds were at the highest since since. One caveat to that is the fact that Japan’s financial year end is likely to see some repatriation. This is another important factor we need to be aware of as there can be big repatriation moves leading up to year end.

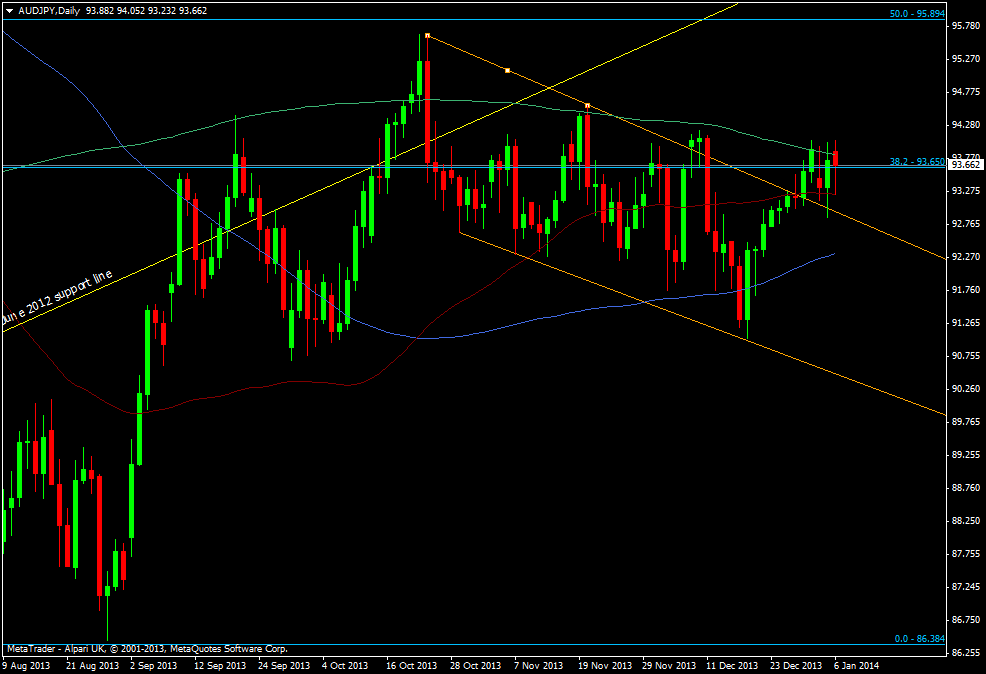

As of now AUD/JPY is being supported along the broken channel top line and 55 dma at 93.23 but is struggling against the 200 dma at 93.82.

- AUD/JPY daily chart 06 01 2014

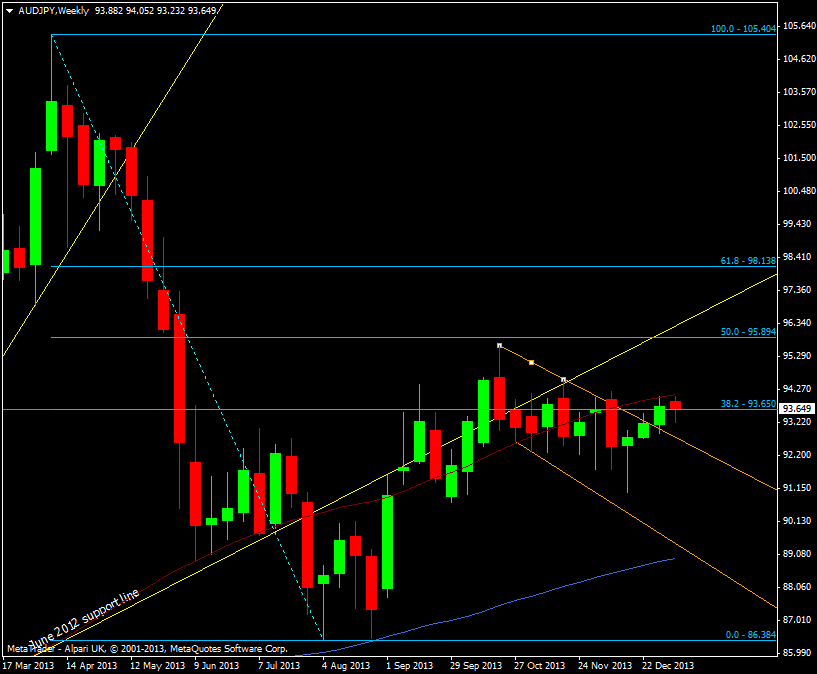

The pair has also been capped recently by the 55 wma at 94.12.

AUD/JPY Weekly chart 06 01 2014